1098T Form Example

1098T Form Example - Insurers file this form for each individual to whom they made reimbursements. This amount may reduce any allowable education credit that you claimed for. Payments received for qualified tuition and.

Insurers file this form for each individual to whom they made reimbursements. This amount may reduce any allowable education credit that you claimed for. Payments received for qualified tuition and.

Payments received for qualified tuition and. Insurers file this form for each individual to whom they made reimbursements. This amount may reduce any allowable education credit that you claimed for.

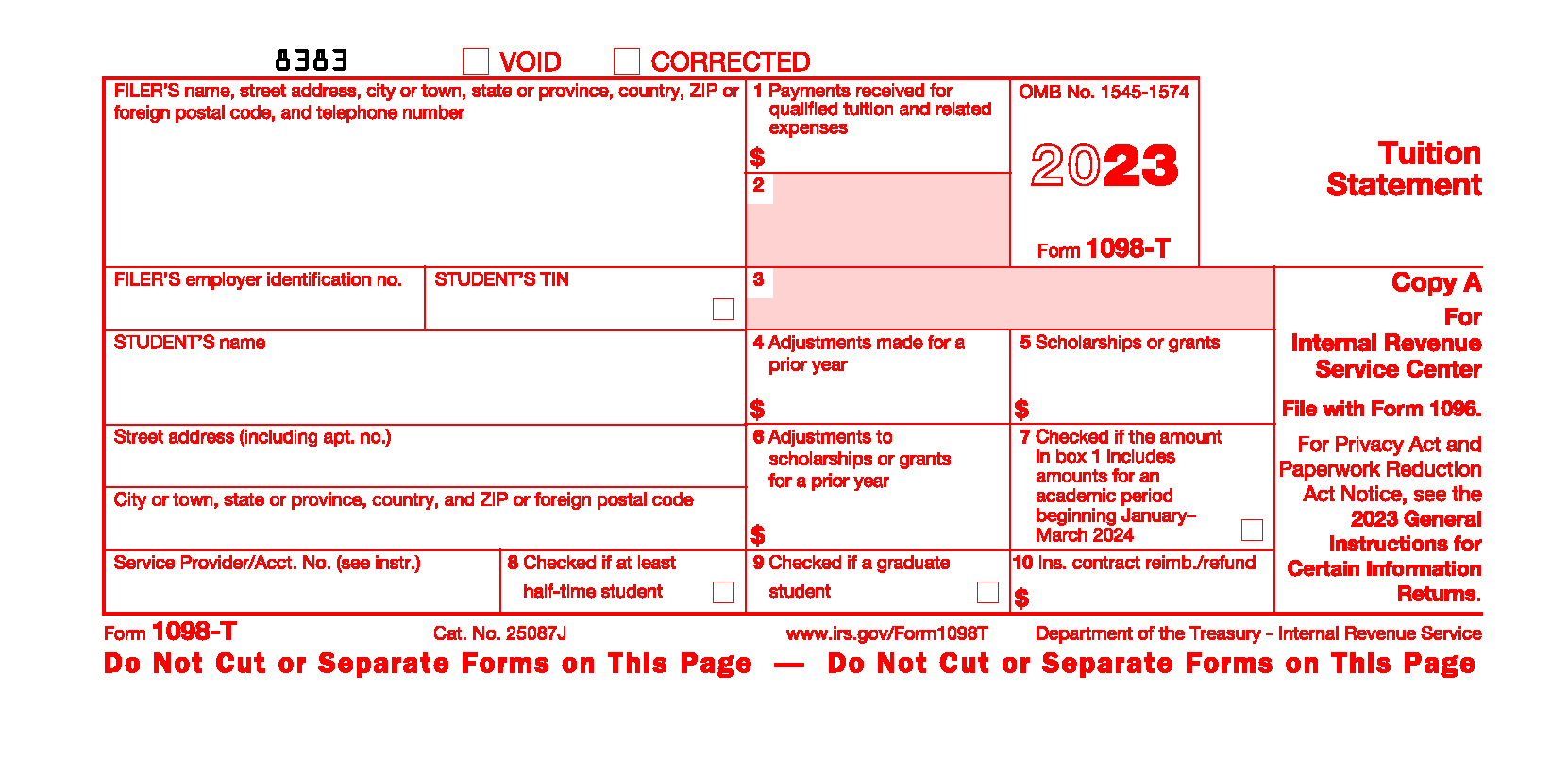

2023 Form 1098T ↳ Get IRS 1098T Tax Form & Tuition Statement

This amount may reduce any allowable education credit that you claimed for. Payments received for qualified tuition and. Insurers file this form for each individual to whom they made reimbursements.

Form 1098T 2024 2025

Payments received for qualified tuition and. Insurers file this form for each individual to whom they made reimbursements. This amount may reduce any allowable education credit that you claimed for.

1098 Form 2023 Printable Forms Free Online

Insurers file this form for each individual to whom they made reimbursements. This amount may reduce any allowable education credit that you claimed for. Payments received for qualified tuition and.

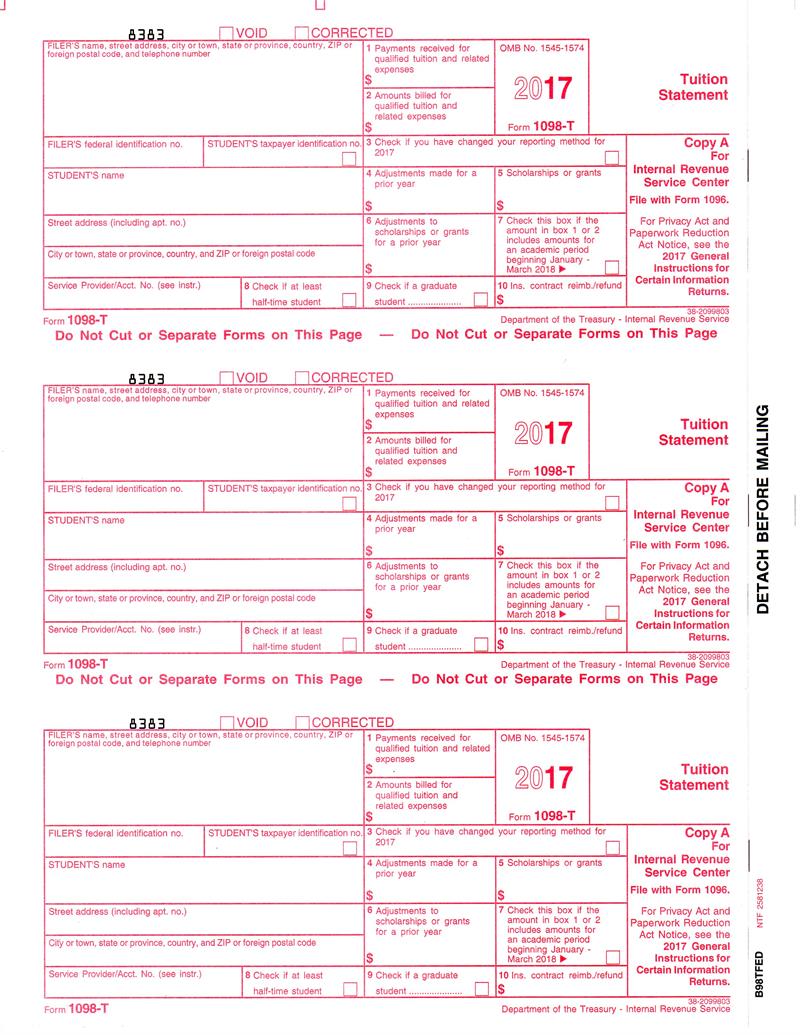

Form 1098T, tUITION sTATEMENT, IRS Copy A

Insurers file this form for each individual to whom they made reimbursements. Payments received for qualified tuition and. This amount may reduce any allowable education credit that you claimed for.

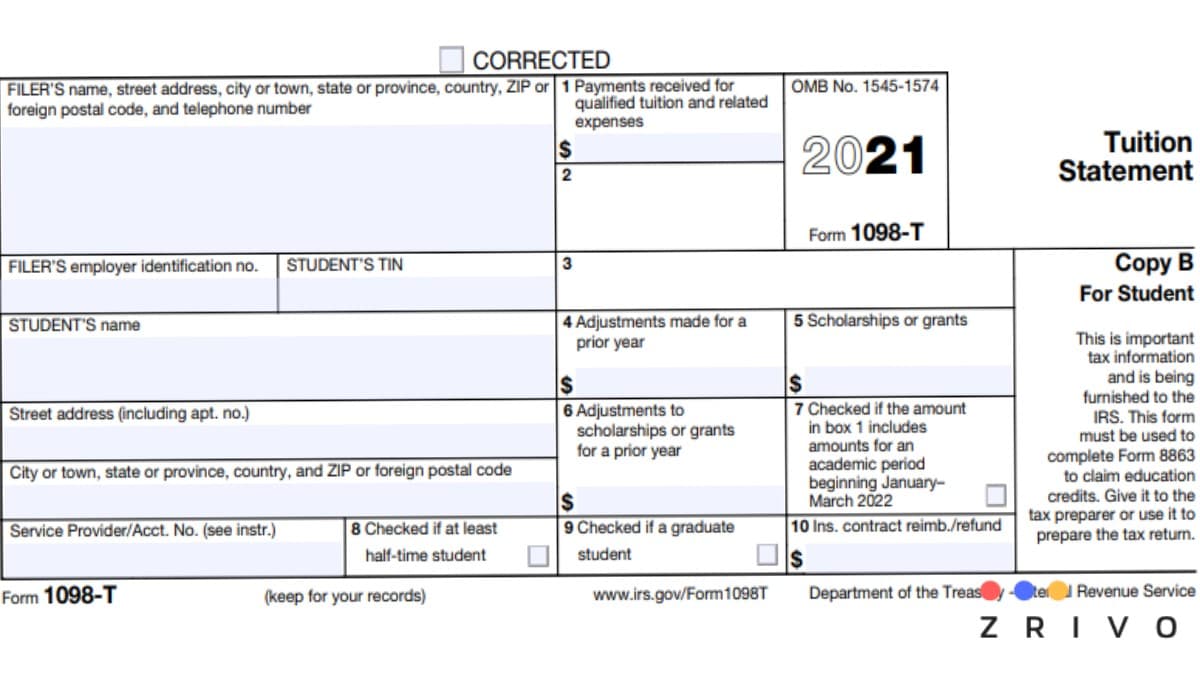

1098 T Form 2021

This amount may reduce any allowable education credit that you claimed for. Payments received for qualified tuition and. Insurers file this form for each individual to whom they made reimbursements.

Form 1098T Information Student Portal

Insurers file this form for each individual to whom they made reimbursements. Payments received for qualified tuition and. This amount may reduce any allowable education credit that you claimed for.

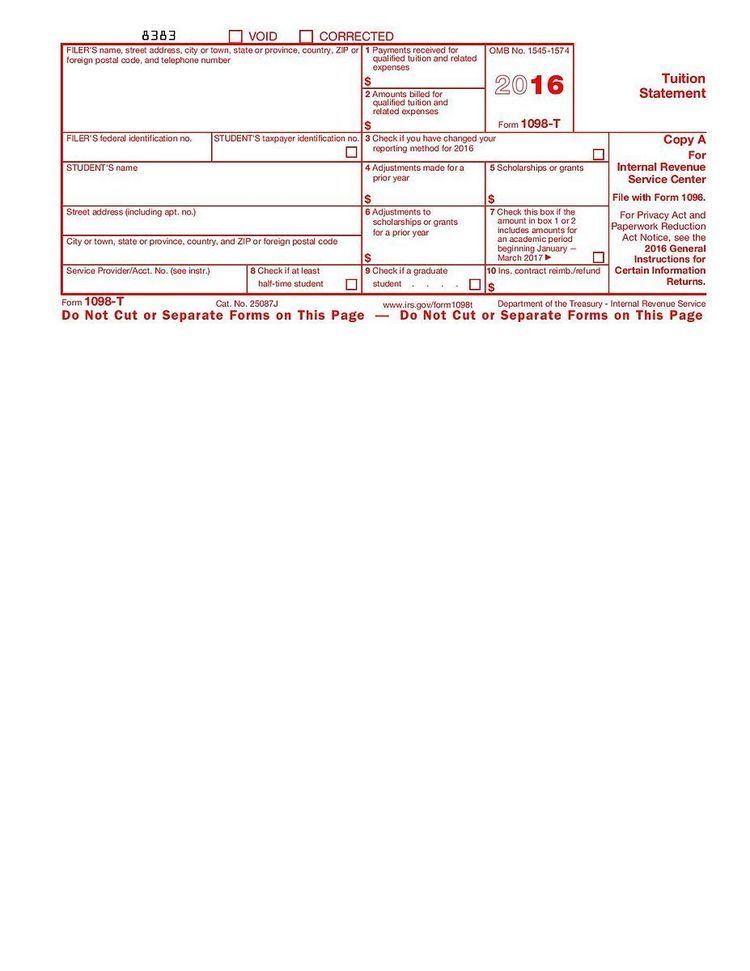

Form 1098 T Alchetron, The Free Social Encyclopedia

This amount may reduce any allowable education credit that you claimed for. Insurers file this form for each individual to whom they made reimbursements. Payments received for qualified tuition and.

Student's 1098T Form PDF PDF Expense Tax Deduction

Insurers file this form for each individual to whom they made reimbursements. This amount may reduce any allowable education credit that you claimed for. Payments received for qualified tuition and.

Tax Form 1098T for 2023 > IRS 1098T Form, Instructions & Printable

This amount may reduce any allowable education credit that you claimed for. Insurers file this form for each individual to whom they made reimbursements. Payments received for qualified tuition and.

This Amount May Reduce Any Allowable Education Credit That You Claimed For.

Insurers file this form for each individual to whom they made reimbursements. Payments received for qualified tuition and.