Costs Of Goods Sold

Costs Of Goods Sold - Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes. Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production.

Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes.

Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production.

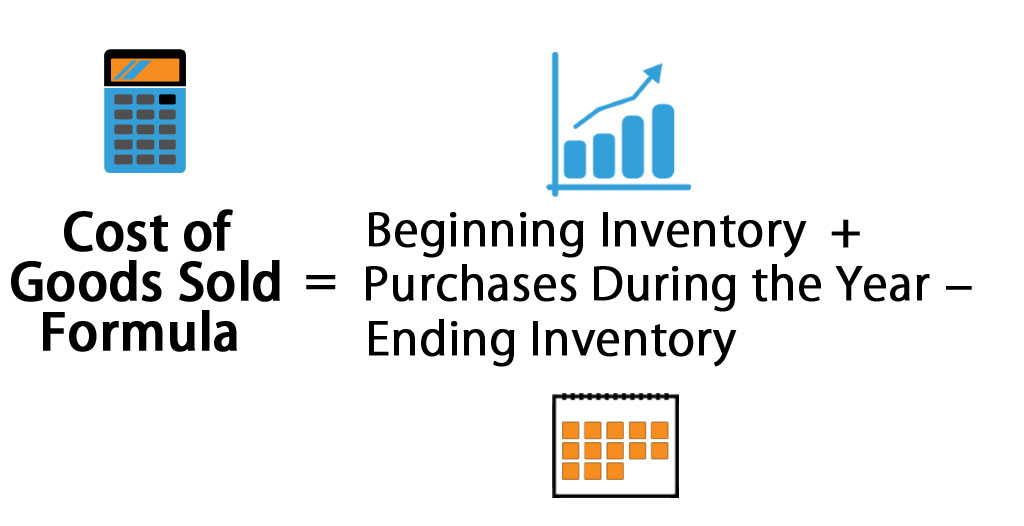

Cost of Goods Sold Accounting Formula to Calculate

Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax.

Cost of Goods Sold Formula Calculator (Excel template)

Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax.

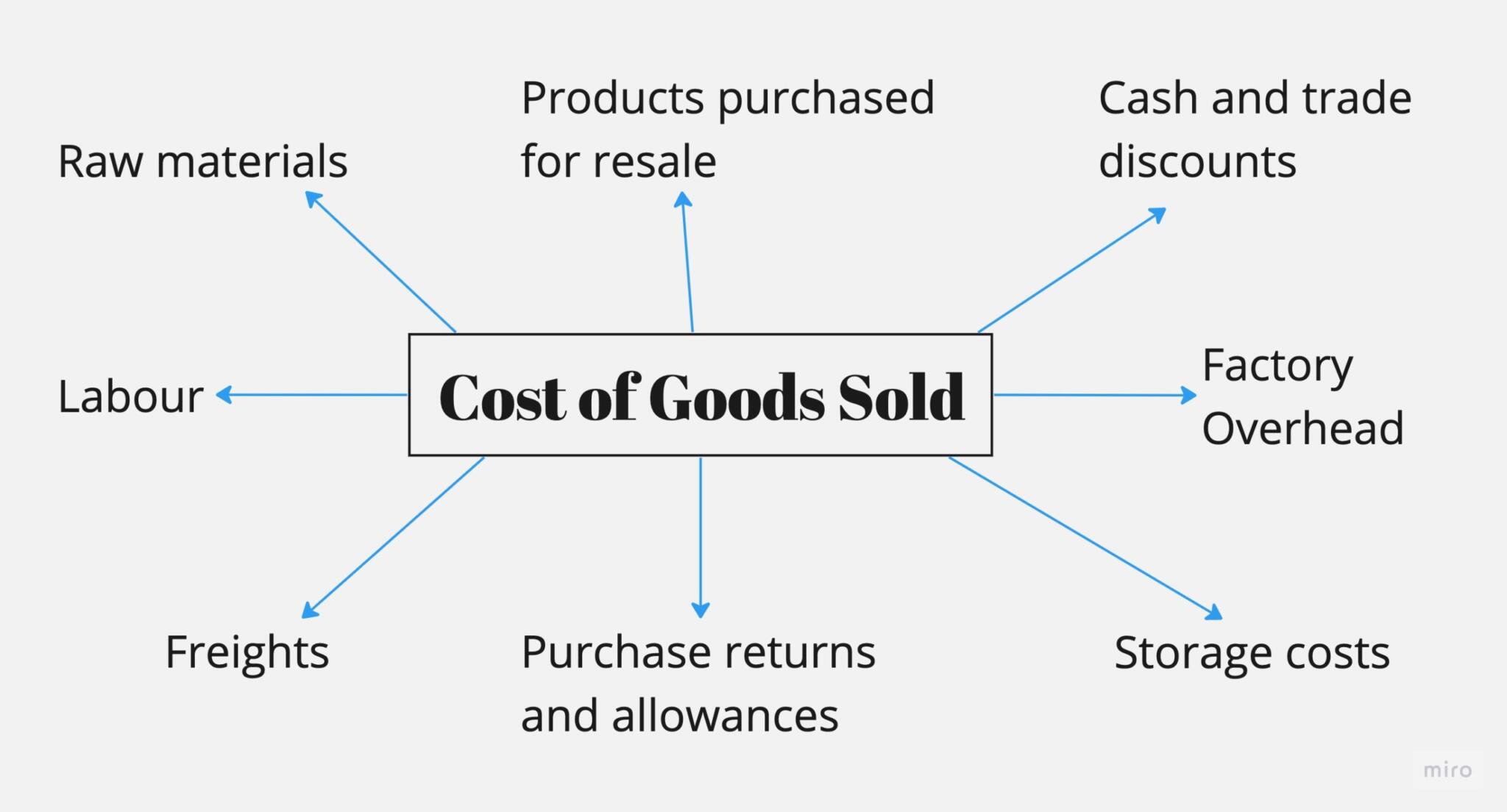

Cost of Goods Sold Formula Calculator, Definition, Formula, Examples

Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and.

costofgoodssold

Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the.

Cost of Goods Sold [Basics Explained & Made Easy]

Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax.

Cost of Goods Sold whats your gross margin like? skillfine

Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax.

Cost of Goods Sold Definition, Calculation, And More Glossary by

Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax.

How to Calculate Cost of Goods Sold in Your Business

Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and.

Cost of Goods Sold [Free Template Download]

Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and.

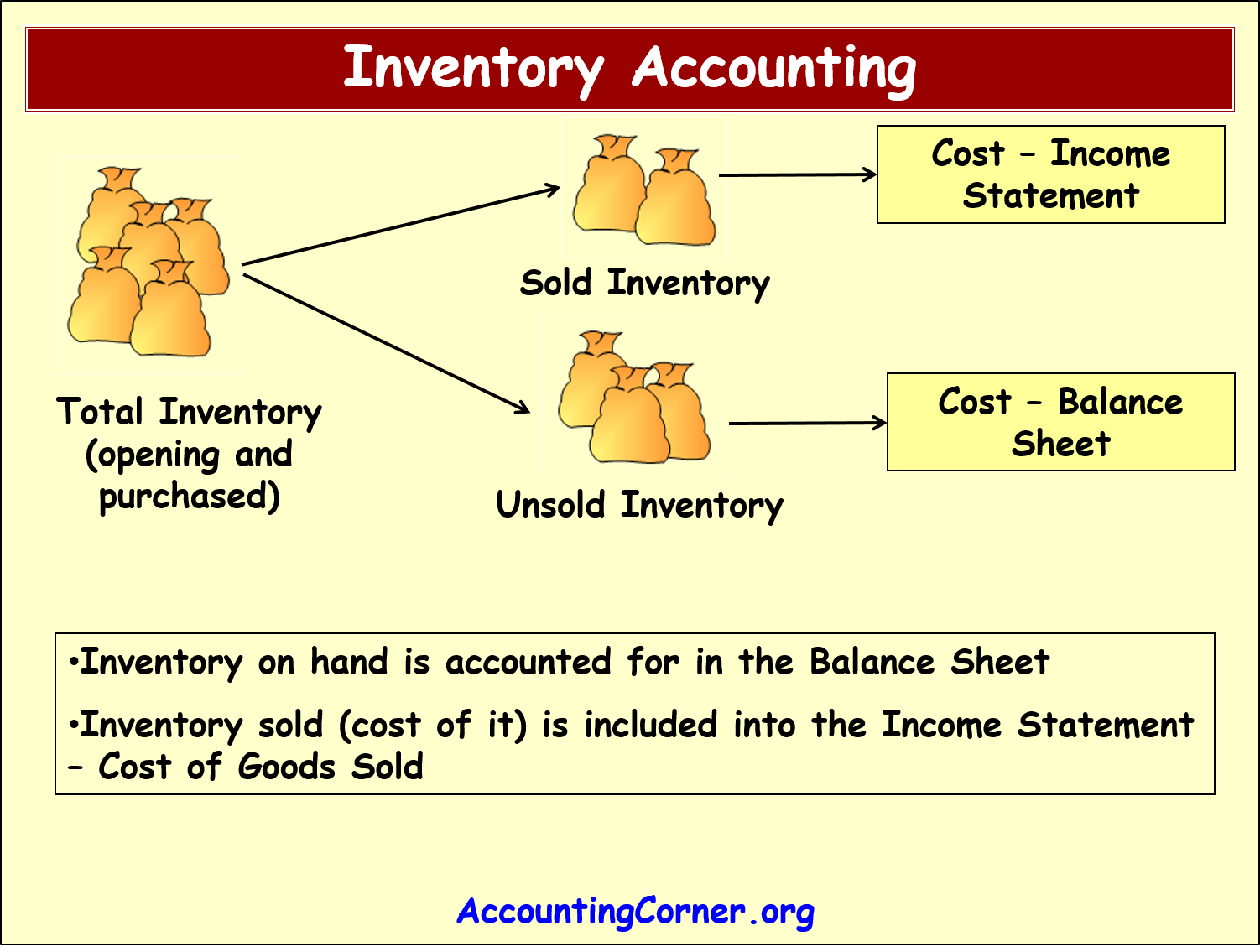

Understanding Cost of Goods Sold

Cost of goods sold (cogs) is a fundamental accounting metric that represents the direct costs associated with the production. Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax.

Cost Of Goods Sold (Cogs) Is A Fundamental Accounting Metric That Represents The Direct Costs Associated With The Production.

Learn what cost of goods sold (cogs) is, how to calculate it, and how it affects gross profit and margin. Learn what cost of goods sold (cogs) is, how it is calculated, and why it is important for accounting and tax purposes.

![Cost of Goods Sold [Basics Explained & Made Easy]](https://learnaccountingskills.com/wp-content/uploads/2023/02/cost-of-goods-sold-explained-1536x806.jpg)

![Cost of Goods Sold [Free Template Download]](https://www.getbackbar.com/hs-fs/hubfs/Cost of Goods Sold Illustration.png?width=3294&name=Cost of Goods Sold Illustration.png)