Farm Sales Tax Exemption Form

Farm Sales Tax Exemption Form - To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse. And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market.

Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse. And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption.

And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption.

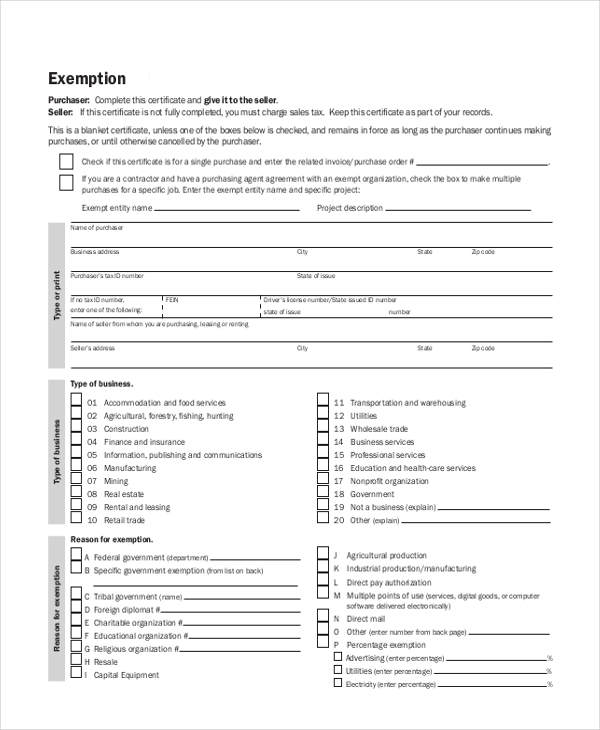

FREE 10+ Sample Tax Exemption Forms in PDF MS Word

Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax.

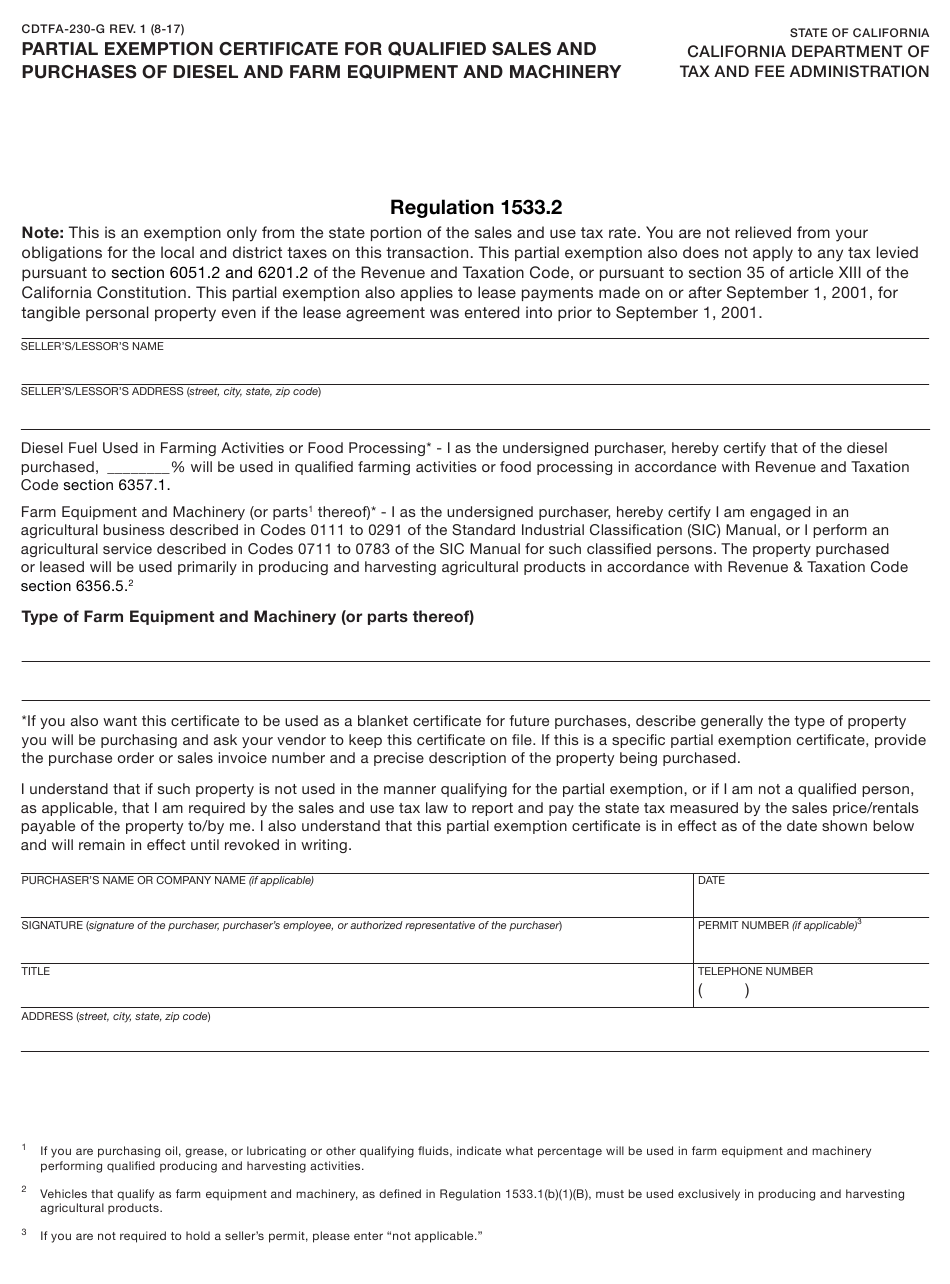

California Farm Tax Exemption Form Fill Online Printable Fillable

And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural.

California Farm Sales Tax Exemption Form

And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural.

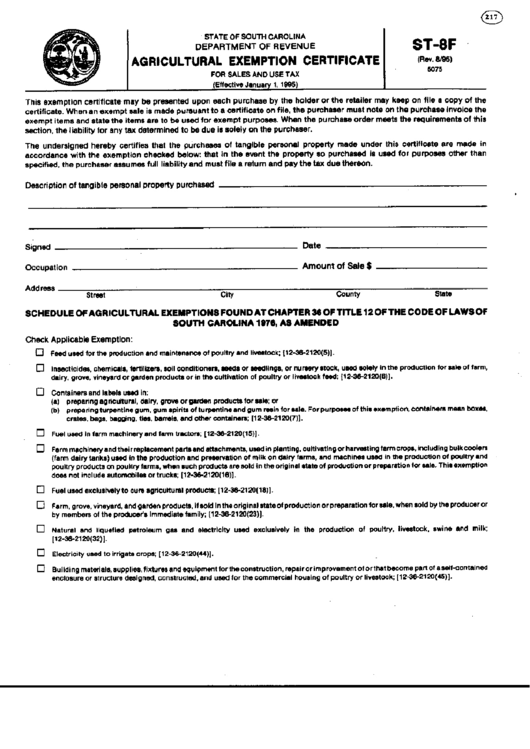

Agricultural Tax Exemption Form Sc

And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or.

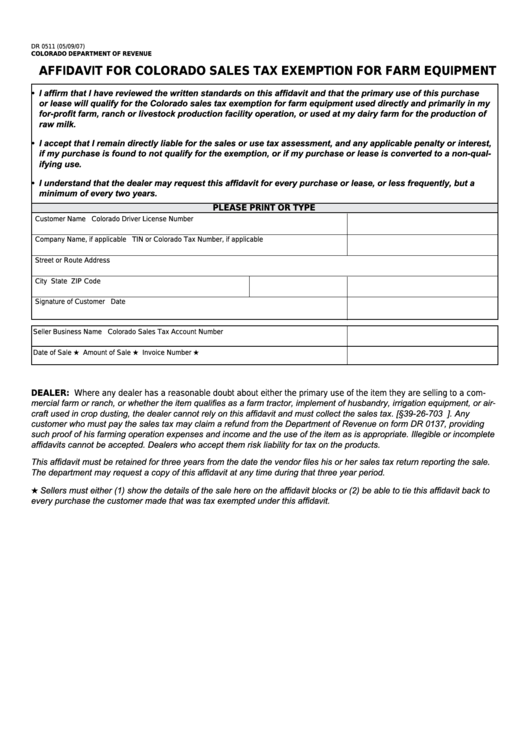

Form Dr 0511 Affidavit For Colorado Sales Tax Exemption For Farm

Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax.

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this.

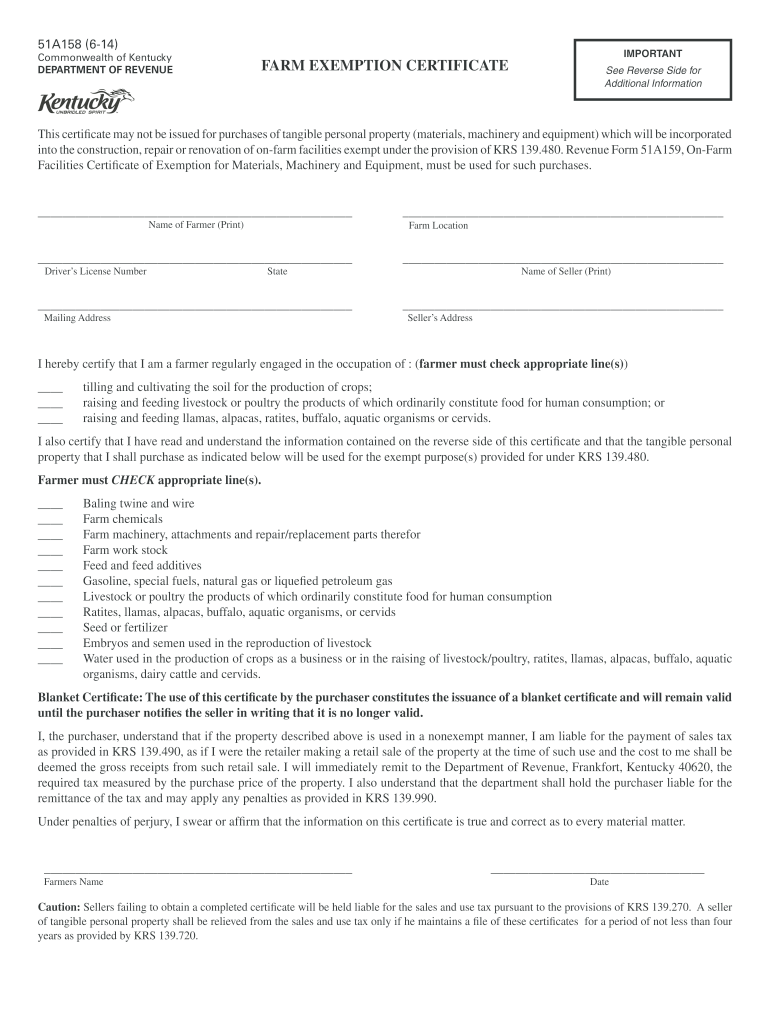

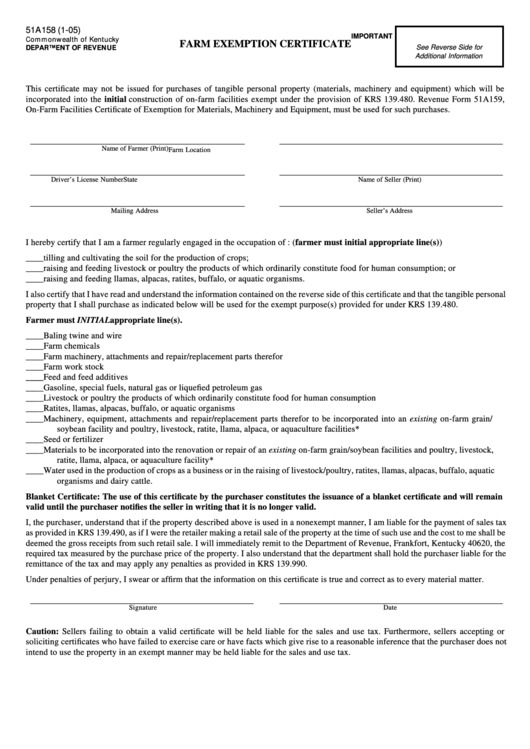

Ky farm tax exempt form online Fill out & sign online DocHub

To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this.

Kentucky Sales Tax Farm Exemption Form Fill Online Printable

And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or.

Farm Sales Tax Exemption Form Texas

And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or.

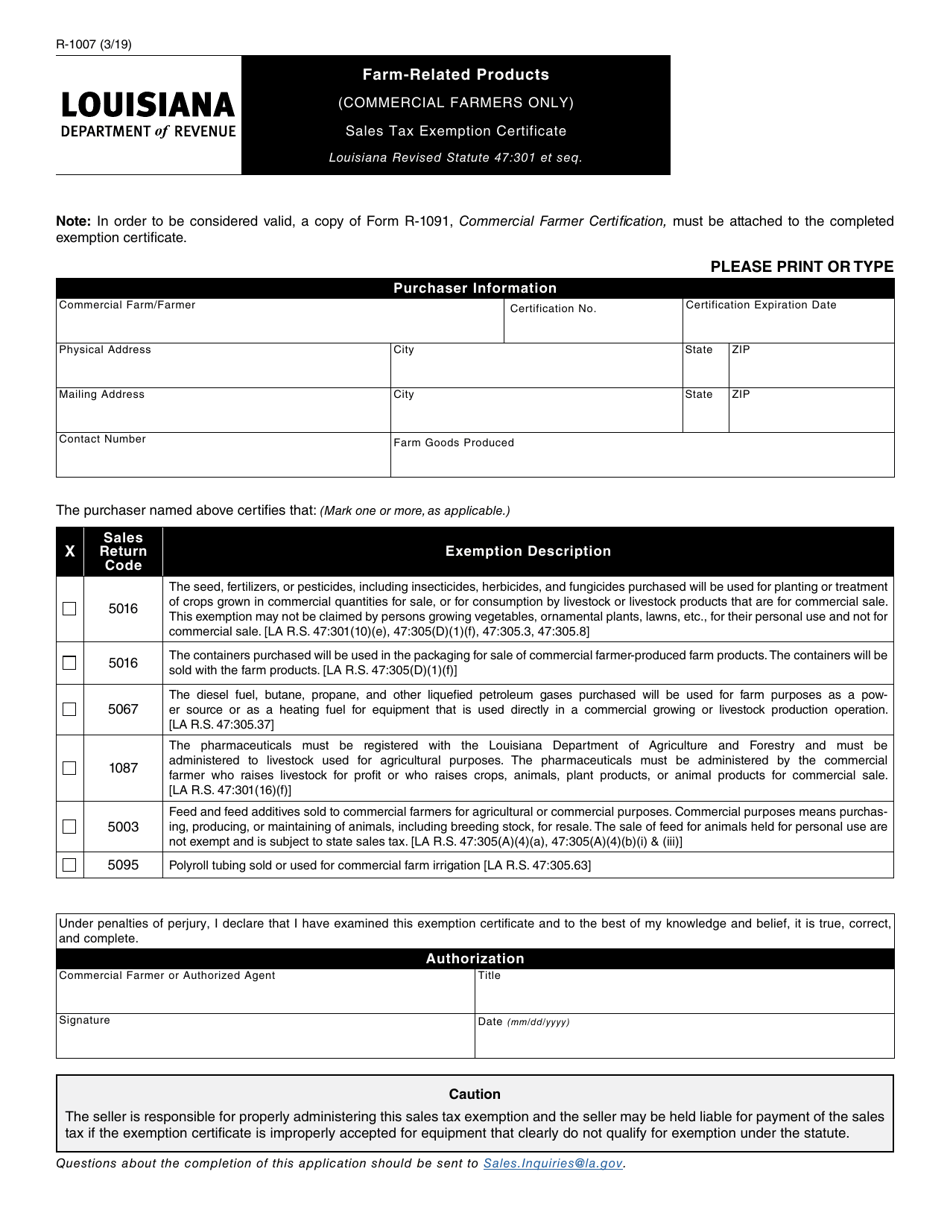

Form R1007 Download Fillable PDF or Fill Online FarmRelated Products

A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. And sales tax exemptions “eligible apiarists” (term defined on page 3) are farmers and may use this form to make tax free purchases of. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying.

And Sales Tax Exemptions “Eligible Apiarists” (Term Defined On Page 3) Are Farmers And May Use This Form To Make Tax Free Purchases Of.

Any contractor who purchases tangible personal property (except structural construction materials) necessary for agricultural production for market. To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption.