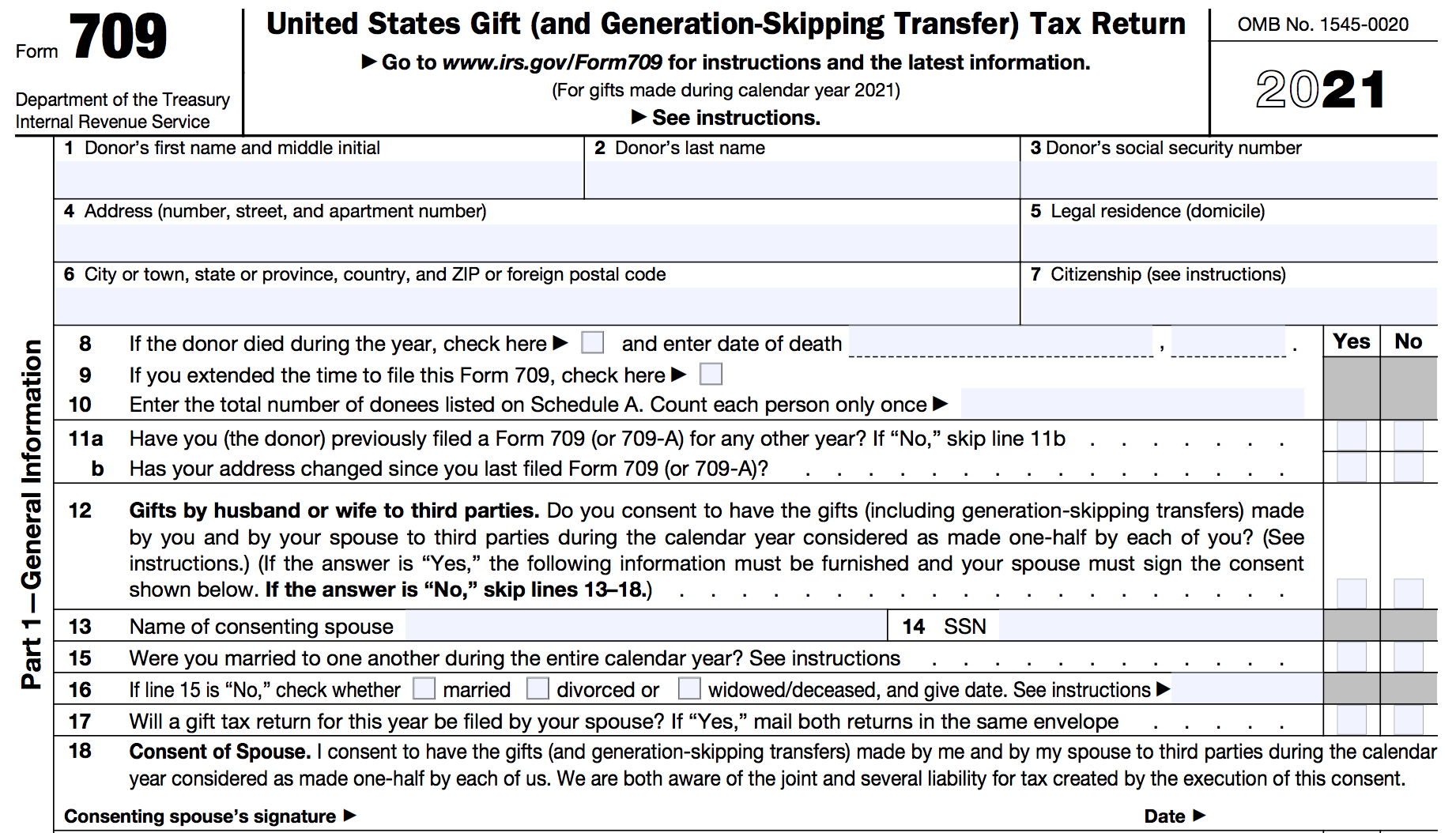

How To Fill Out 709 Form

How To Fill Out 709 Form - If you made substantial gifts this year, you may need to fill out form 709. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Transfers subject to the federal gift and certain. Use form 709 to report the following.

Use form 709 to report the following. Transfers subject to the federal gift and certain. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. If you made substantial gifts this year, you may need to fill out form 709.

If you made substantial gifts this year, you may need to fill out form 709. Use form 709 to report the following. Transfers subject to the federal gift and certain. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax.

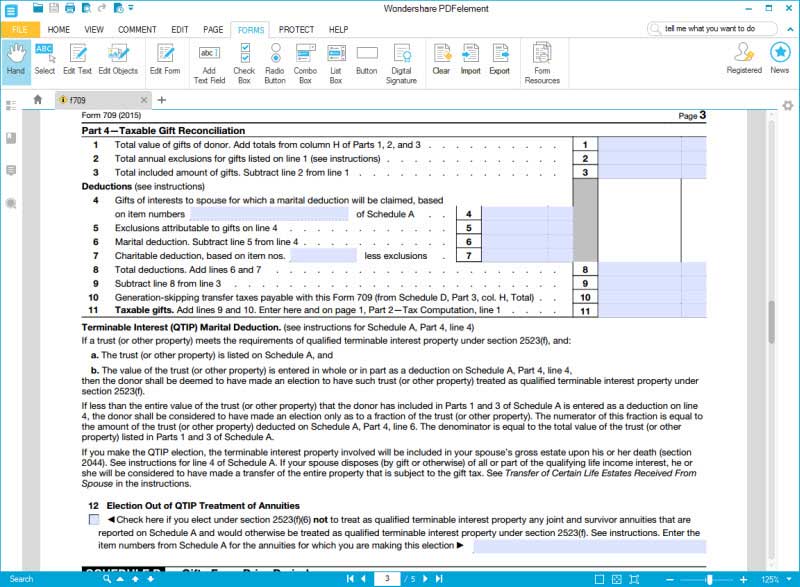

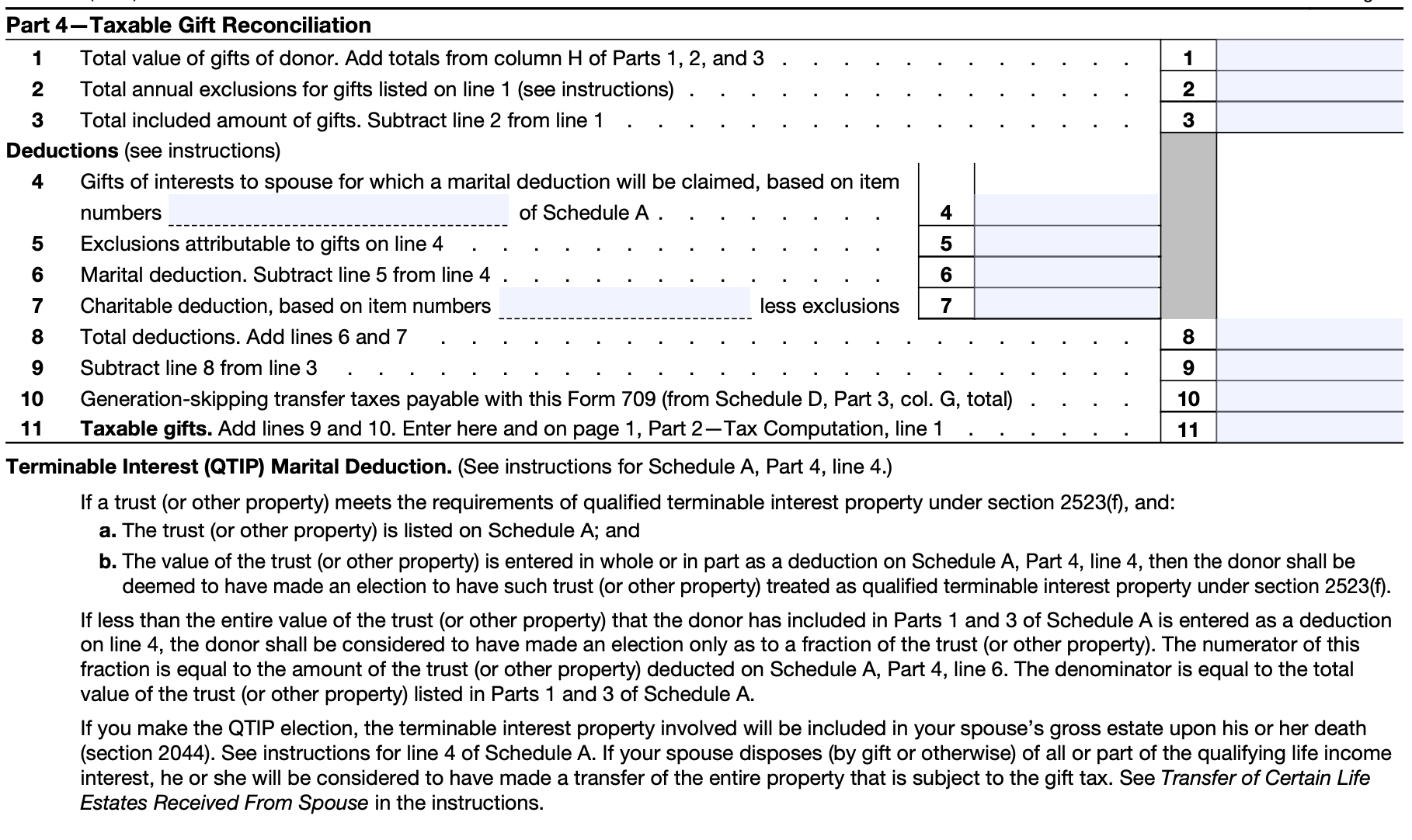

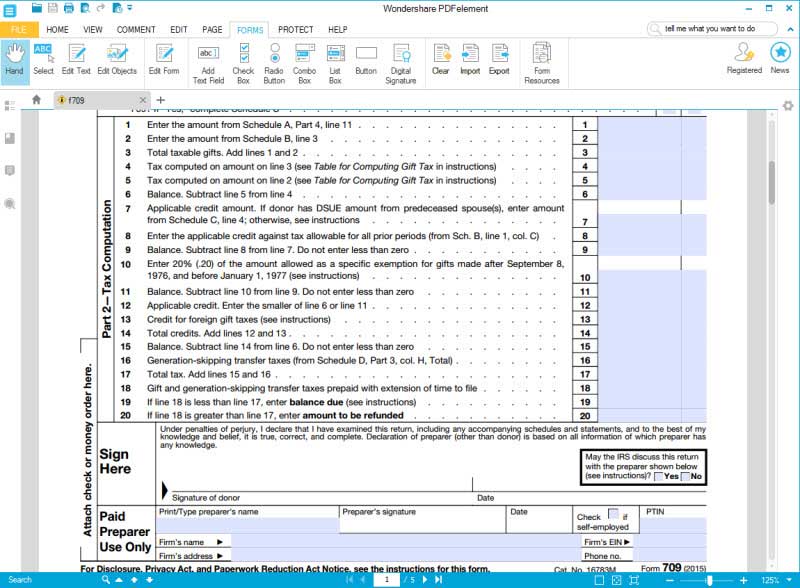

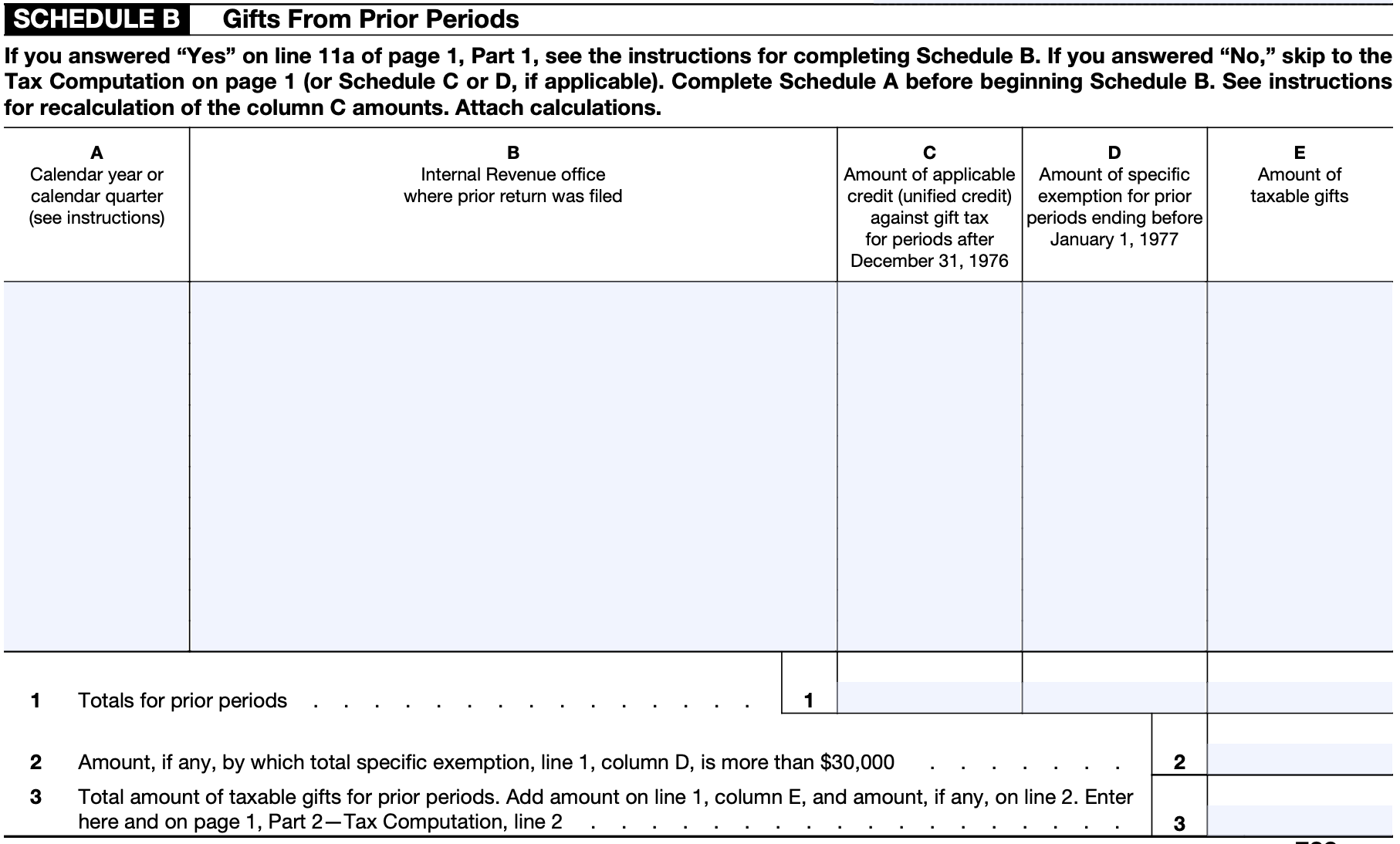

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax

Use form 709 to report the following. If you made substantial gifts this year, you may need to fill out form 709. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Transfers subject to the federal gift and certain.

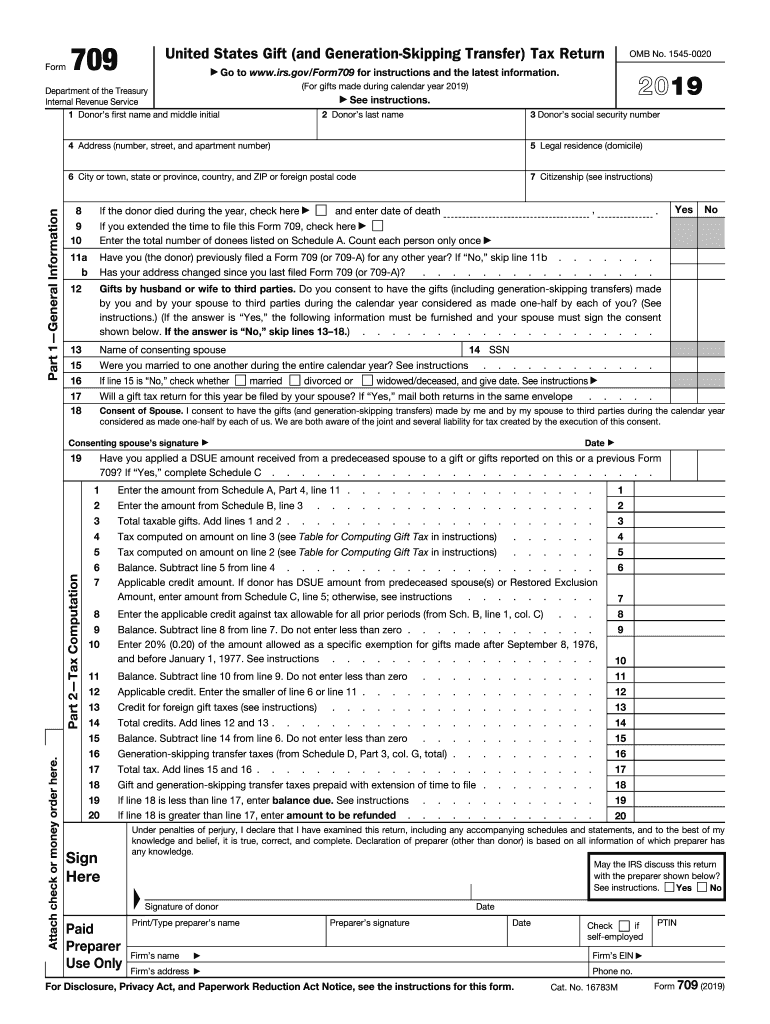

2019 Form IRS 709 Fill Online, Printable, Fillable, Blank pdfFiller

If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Transfers subject to the federal gift and certain. Use form 709 to report the following. If you made substantial gifts this year, you may need to fill out form 709.

How to Fill Out Form 709

Transfers subject to the federal gift and certain. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Use form 709 to report the following. If you made substantial gifts this year, you may need to fill out form 709.

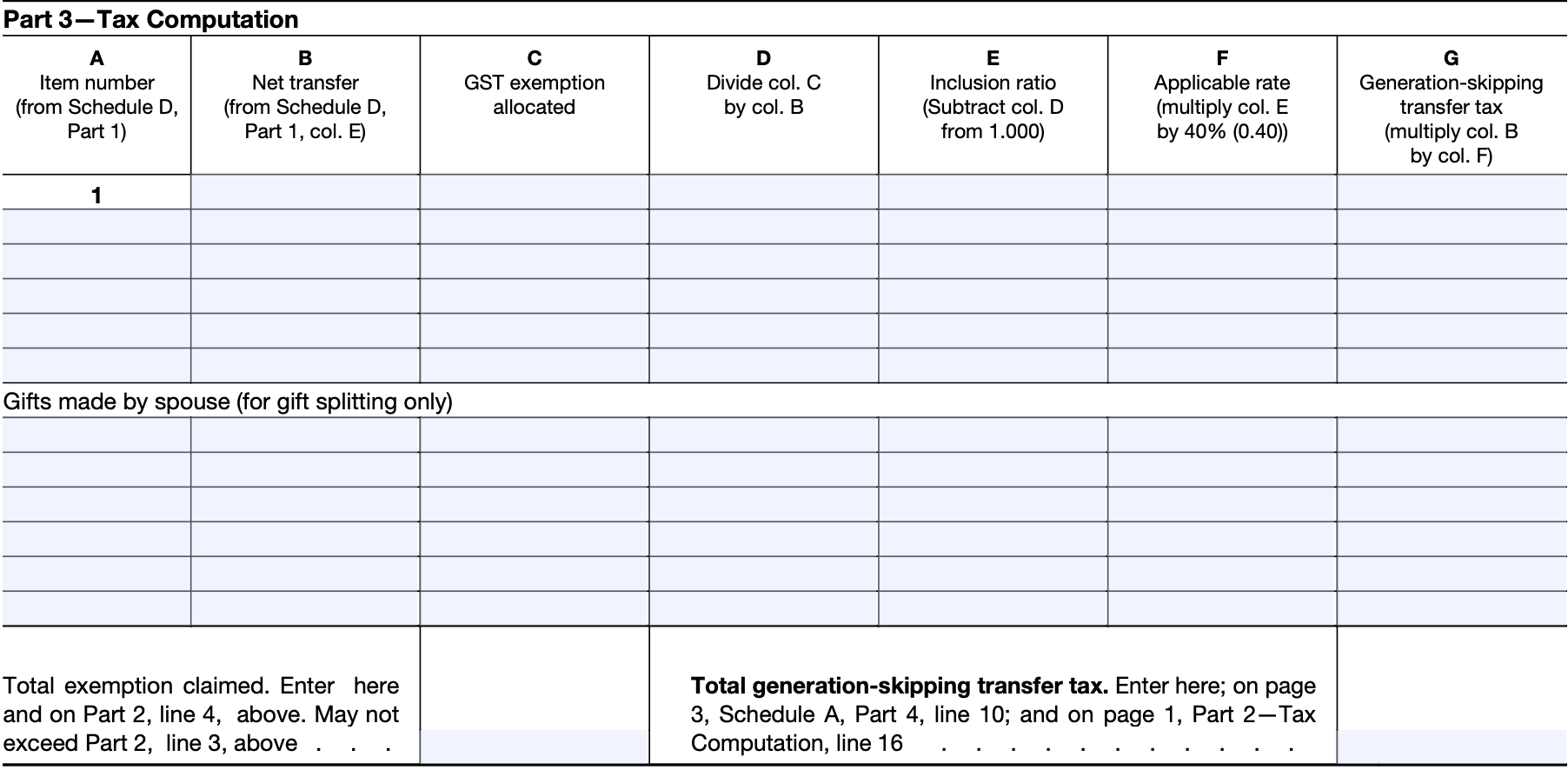

How to Fill Out Form 709

Use form 709 to report the following. If you made substantial gifts this year, you may need to fill out form 709. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Transfers subject to the federal gift and certain.

Form 709 Instructions 2024 Fill online, Printable, Fillable Blank

If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Transfers subject to the federal gift and certain. Use form 709 to report the following. If you made substantial gifts this year, you may need to fill out form 709.

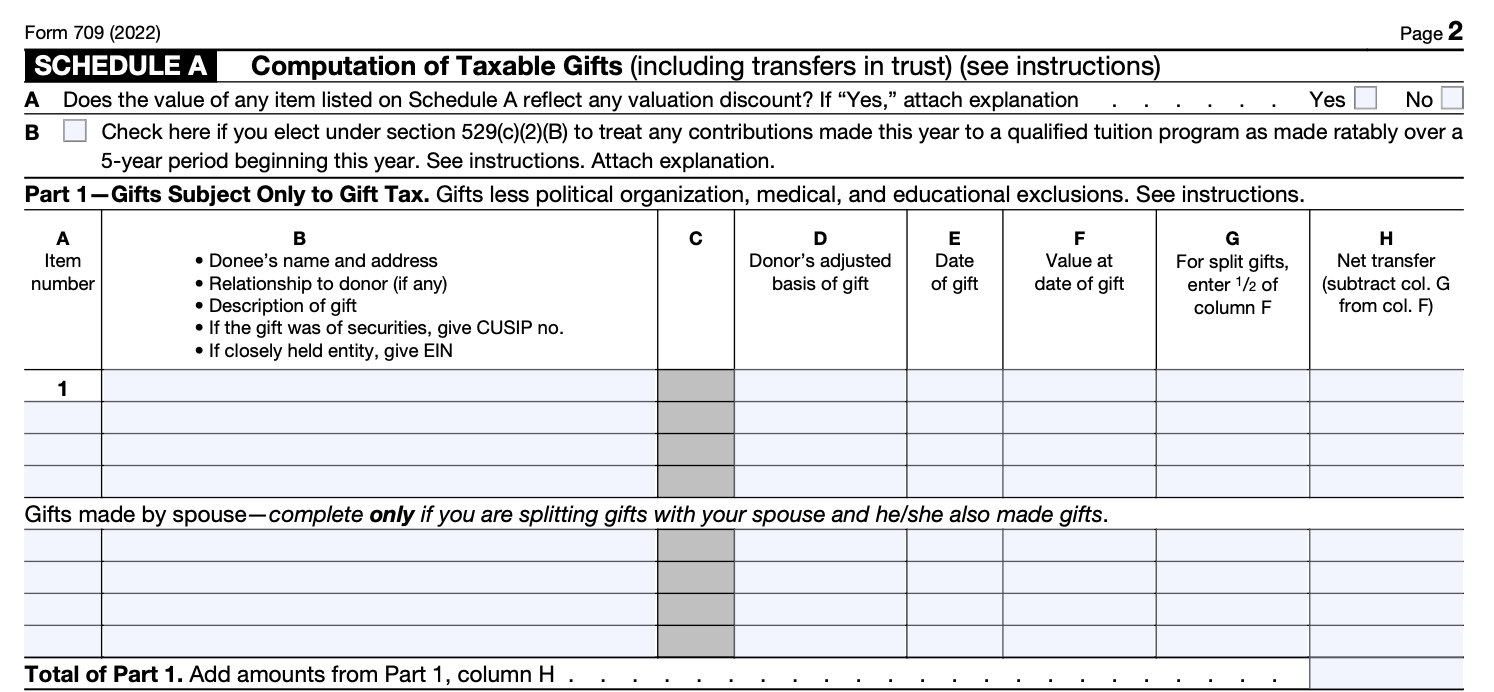

Instructions for How to Fill in IRS Form 709

If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Use form 709 to report the following. Transfers subject to the federal gift and certain. If you made substantial gifts this year, you may need to fill out form 709.

How to Fill Out Form 709

Use form 709 to report the following. If you made substantial gifts this year, you may need to fill out form 709. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Transfers subject to the federal gift and certain.

Instructions for How to Fill in IRS Form 709

Transfers subject to the federal gift and certain. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. If you made substantial gifts this year, you may need to fill out form 709. Use form 709 to report the following.

How to Fill Out Form 709

If you made substantial gifts this year, you may need to fill out form 709. Use form 709 to report the following. Transfers subject to the federal gift and certain. If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax.

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax

If your gift exceeds the yearly limit ($17,000 per individual) imposed by the gift tax. Transfers subject to the federal gift and certain. If you made substantial gifts this year, you may need to fill out form 709. Use form 709 to report the following.

If Your Gift Exceeds The Yearly Limit ($17,000 Per Individual) Imposed By The Gift Tax.

Transfers subject to the federal gift and certain. Use form 709 to report the following. If you made substantial gifts this year, you may need to fill out form 709.