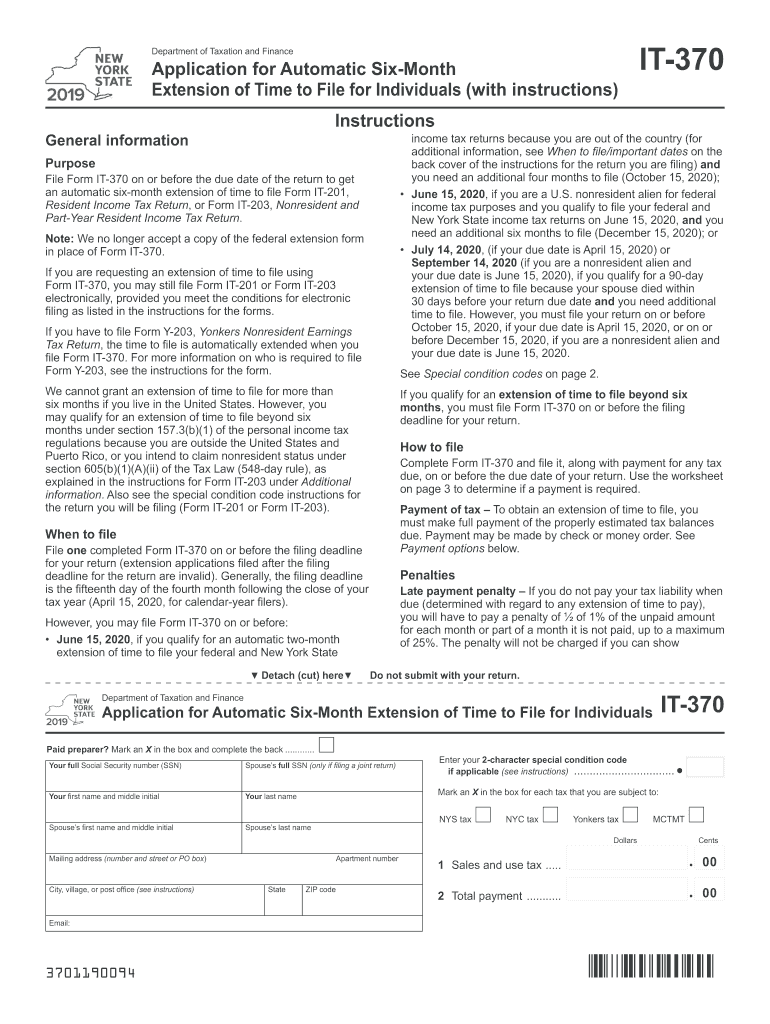

Nys Income Tax Extension Form It 370

Nys Income Tax Extension Form It 370 - Income tax applications for filing extensions. If you file your extension application after the filing deadline for the return: Get more information if you need to. Any balance due with this automatic extension of time to file. If you can't file on time, you can request an automatic extension of time to file the following. Make the check or money order.

Make the check or money order. Any balance due with this automatic extension of time to file. Income tax applications for filing extensions. If you can't file on time, you can request an automatic extension of time to file the following. Get more information if you need to. If you file your extension application after the filing deadline for the return:

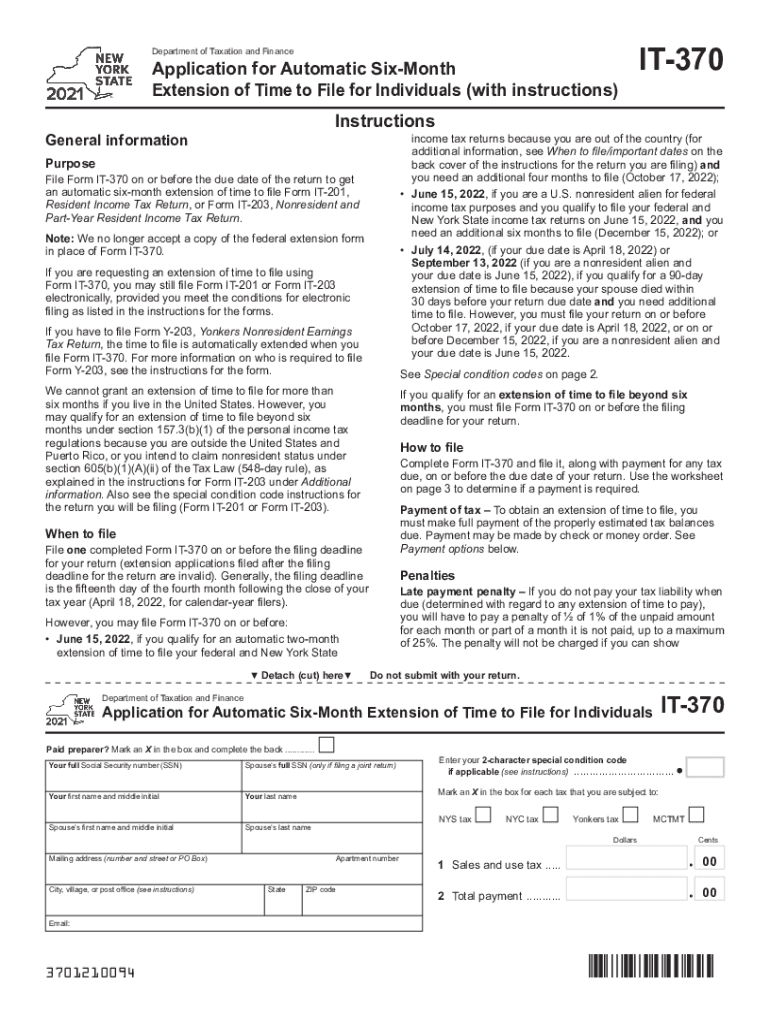

Make the check or money order. Income tax applications for filing extensions. Any balance due with this automatic extension of time to file. Get more information if you need to. If you can't file on time, you can request an automatic extension of time to file the following. If you file your extension application after the filing deadline for the return:

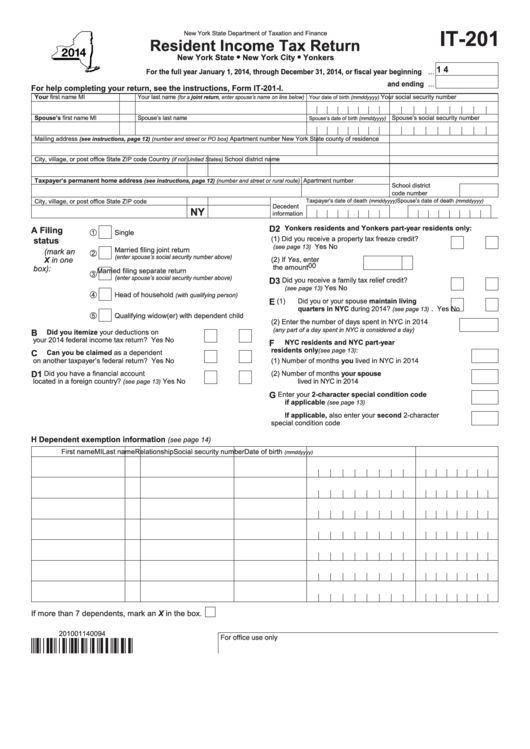

Form It370 2015 Department Of Taxation And Finance Application For

Make the check or money order. Income tax applications for filing extensions. If you can't file on time, you can request an automatic extension of time to file the following. Get more information if you need to. Any balance due with this automatic extension of time to file.

Ny State it 370 20192024 Form Fill Out and Sign Printable PDF

Get more information if you need to. Income tax applications for filing extensions. If you file your extension application after the filing deadline for the return: Make the check or money order. If you can't file on time, you can request an automatic extension of time to file the following.

Tax Extension Form 2024 Drona Ainslee

Income tax applications for filing extensions. Get more information if you need to. If you file your extension application after the filing deadline for the return: Make the check or money order. If you can't file on time, you can request an automatic extension of time to file the following.

Fill Free fillable forms for New York State

Make the check or money order. Get more information if you need to. If you file your extension application after the filing deadline for the return: If you can't file on time, you can request an automatic extension of time to file the following. Income tax applications for filing extensions.

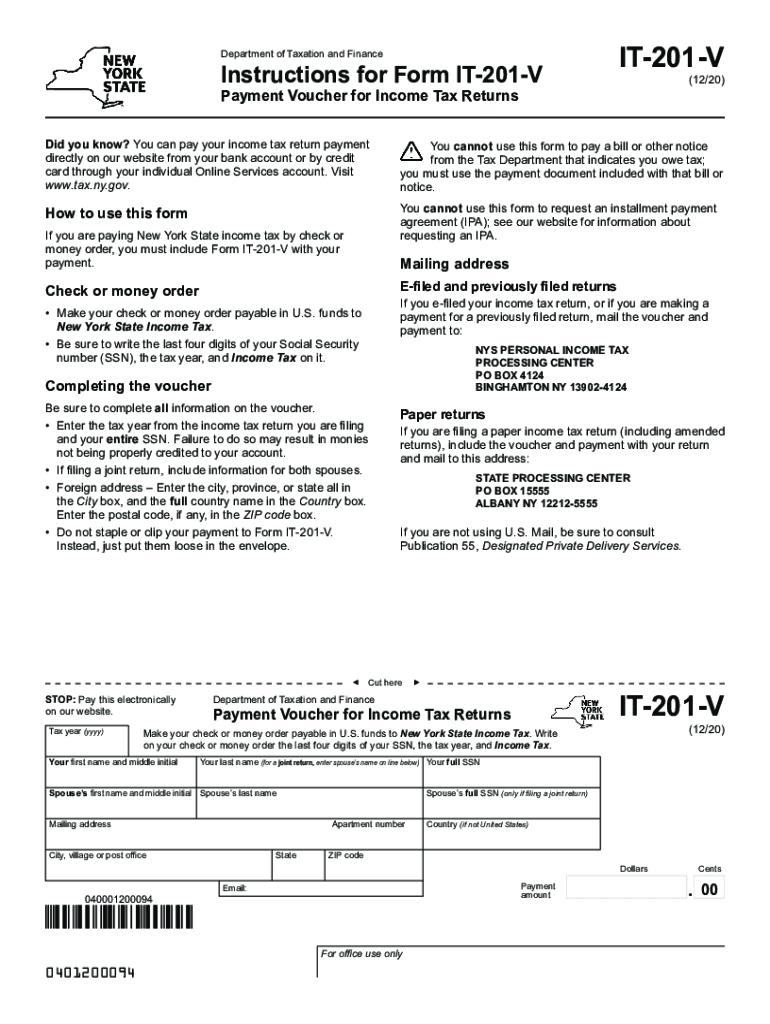

Fillable Online New York State Tax Form 201 Instructions Fax

Any balance due with this automatic extension of time to file. If you file your extension application after the filing deadline for the return: Get more information if you need to. Income tax applications for filing extensions. Make the check or money order.

NY DTF IT201 2025 Form Printable Blank PDF Online

Any balance due with this automatic extension of time to file. If you file your extension application after the filing deadline for the return: If you can't file on time, you can request an automatic extension of time to file the following. Make the check or money order. Income tax applications for filing extensions.

New york state tax forms get Fill out & sign online DocHub

Income tax applications for filing extensions. Get more information if you need to. If you file your extension application after the filing deadline for the return: If you can't file on time, you can request an automatic extension of time to file the following. Any balance due with this automatic extension of time to file.

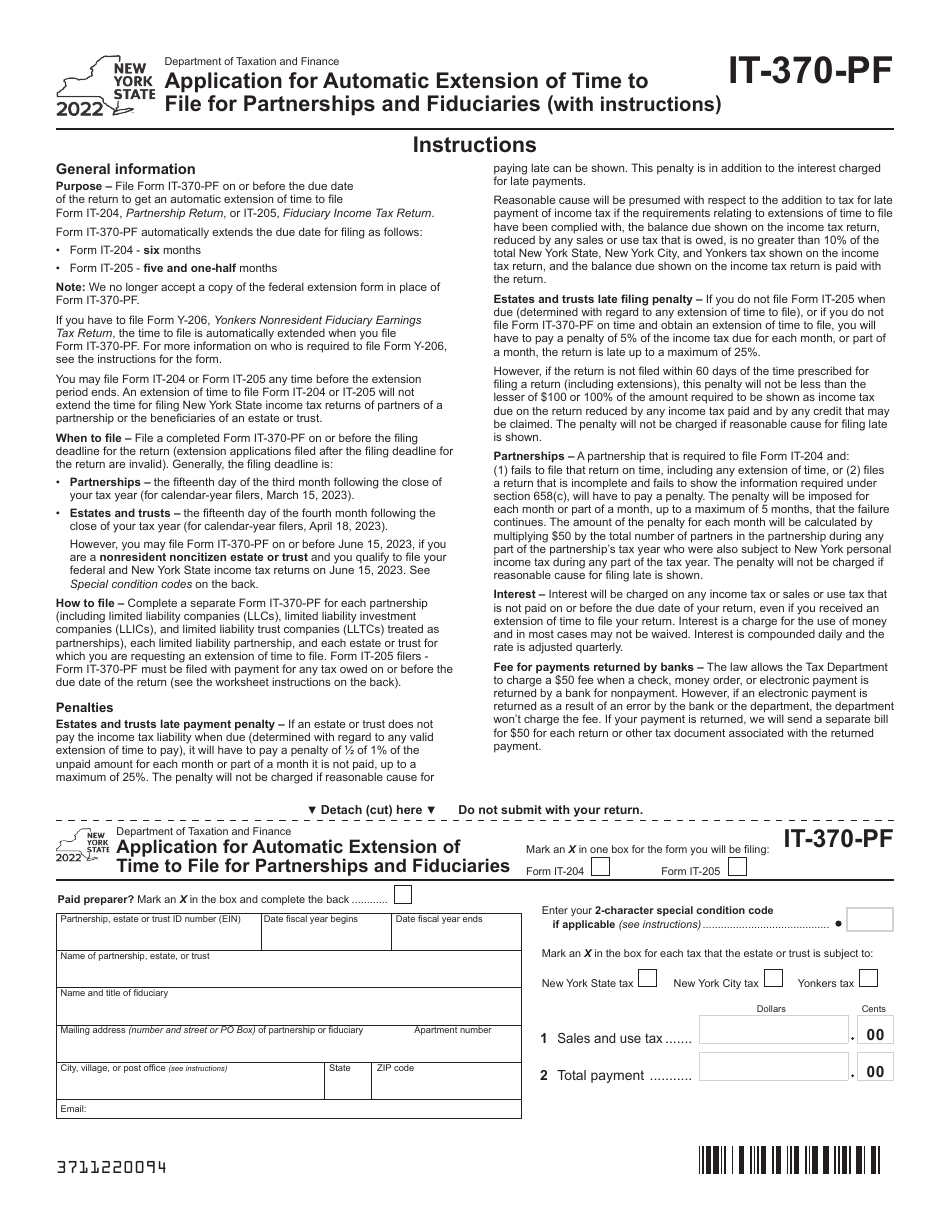

Form IT370PF Download Fillable PDF or Fill Online Application for

Make the check or money order. Any balance due with this automatic extension of time to file. Income tax applications for filing extensions. If you file your extension application after the filing deadline for the return: If you can't file on time, you can request an automatic extension of time to file the following.

Tax Extension Form 2024 Betti Chelsea

Any balance due with this automatic extension of time to file. Make the check or money order. If you file your extension application after the filing deadline for the return: Get more information if you need to. Income tax applications for filing extensions.

Nys Fillable Tax Form Printable Forms Free Online

If you can't file on time, you can request an automatic extension of time to file the following. Income tax applications for filing extensions. Any balance due with this automatic extension of time to file. Make the check or money order. If you file your extension application after the filing deadline for the return:

Any Balance Due With This Automatic Extension Of Time To File.

If you can't file on time, you can request an automatic extension of time to file the following. If you file your extension application after the filing deadline for the return: Make the check or money order. Income tax applications for filing extensions.