Tax Exempt Form New York

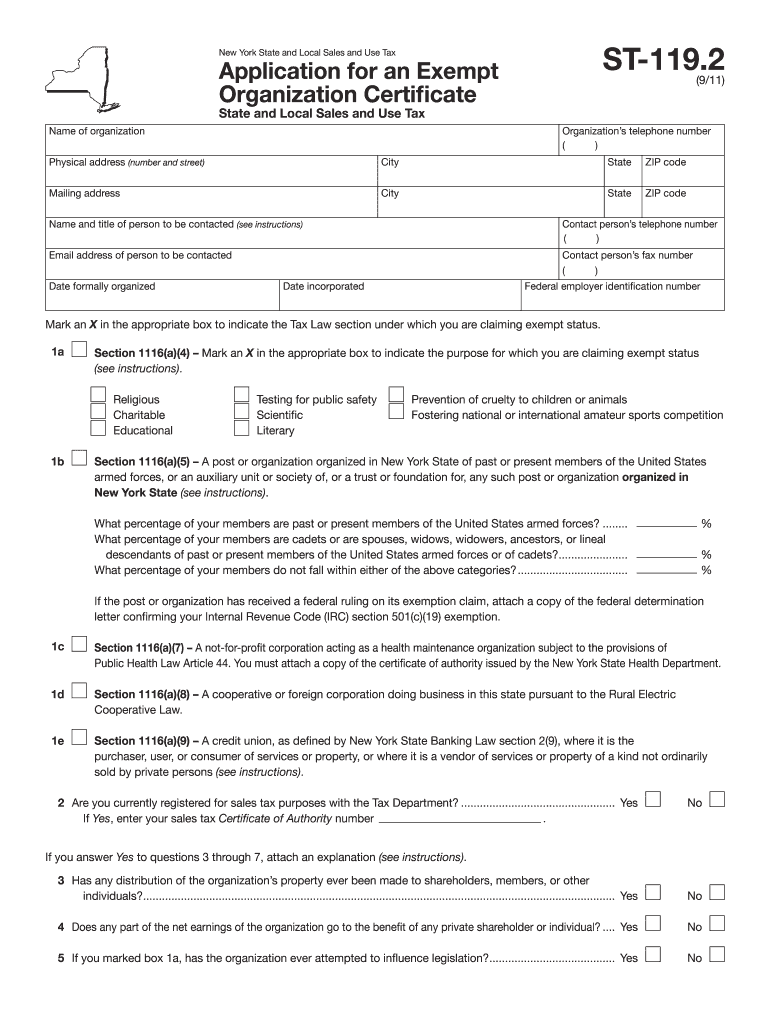

Tax Exempt Form New York - As a new york state registered vendor, you may accept an exemption certificate in lieu of. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Carefully read the instructions and other information on the back of this document. Purchases described in items a through f are exempt from all state and local sales and use.

As a new york state registered vendor, you may accept an exemption certificate in lieu of. Purchases described in items a through f are exempt from all state and local sales and use. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Carefully read the instructions and other information on the back of this document.

As a new york state registered vendor, you may accept an exemption certificate in lieu of. Carefully read the instructions and other information on the back of this document. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Purchases described in items a through f are exempt from all state and local sales and use.

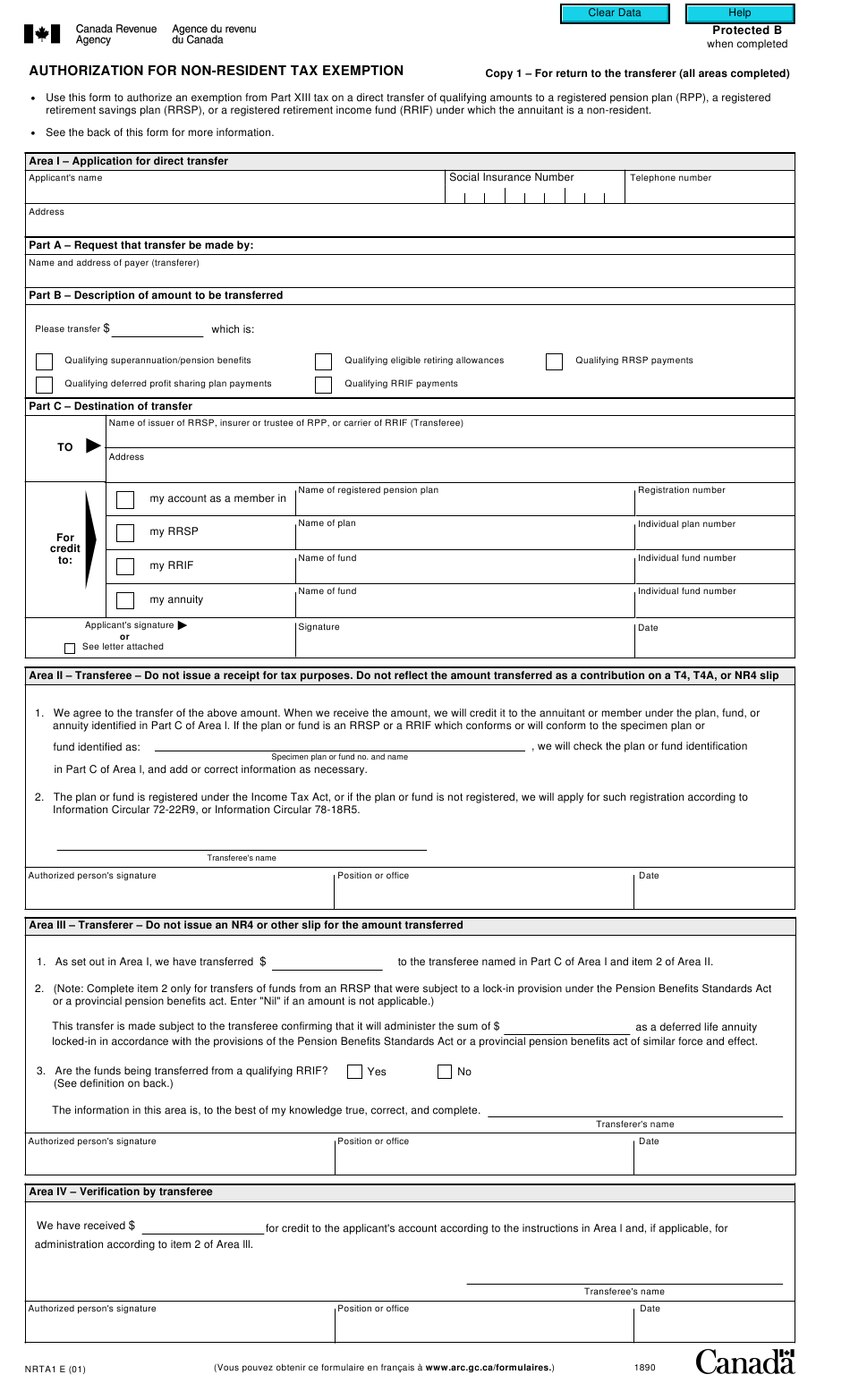

Non Resident Sales Tax Exemption Form

Carefully read the instructions and other information on the back of this document. Businesses can apply for certificates that exempt them from paying sales tax on certain items. As a new york state registered vendor, you may accept an exemption certificate in lieu of. Purchases described in items a through f are exempt from all state and local sales and.

Form DTF803 Claim for Sales and Use Tax Exemption New York Free

As a new york state registered vendor, you may accept an exemption certificate in lieu of. Carefully read the instructions and other information on the back of this document. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Purchases described in items a through f are exempt from all state and local sales and.

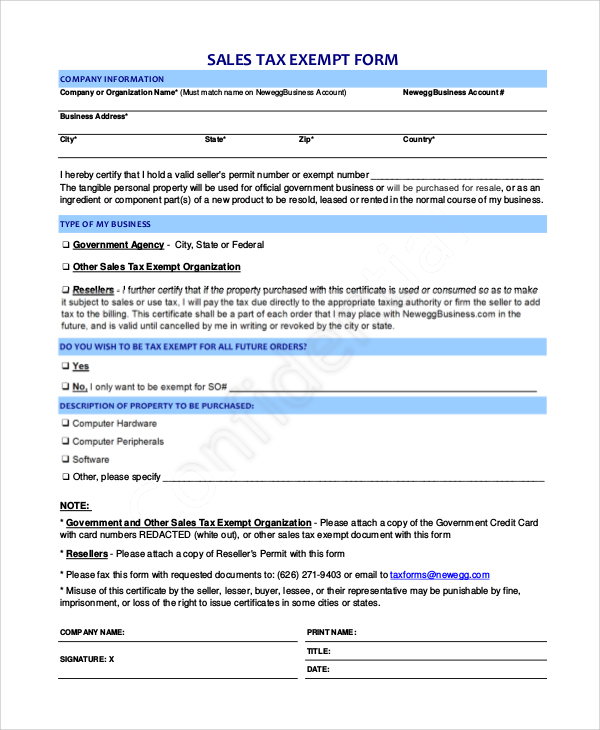

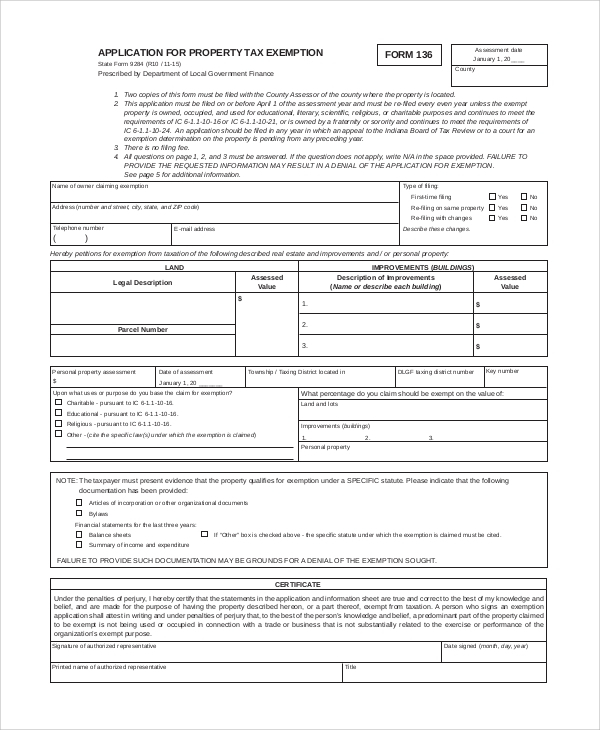

FREE 10+ Sample Tax Exemption Forms in PDF

Purchases described in items a through f are exempt from all state and local sales and use. As a new york state registered vendor, you may accept an exemption certificate in lieu of. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Carefully read the instructions and other information on the back of this.

Sales Tax Exemption Certificate New York 20112024 Form Fill Out and

Carefully read the instructions and other information on the back of this document. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Purchases described in items a through f are exempt from all state and local sales and use. As a new york state registered vendor, you may accept an exemption certificate in lieu.

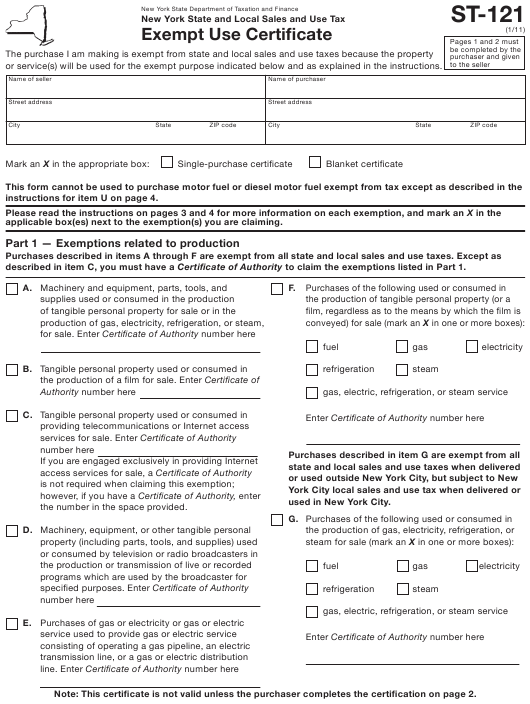

Nys Sales Tax Exempt Form St 121

Carefully read the instructions and other information on the back of this document. Purchases described in items a through f are exempt from all state and local sales and use. Businesses can apply for certificates that exempt them from paying sales tax on certain items. As a new york state registered vendor, you may accept an exemption certificate in lieu.

State Sales Tax State Sales Tax Exemption Certificate New York

Businesses can apply for certificates that exempt them from paying sales tax on certain items. Purchases described in items a through f are exempt from all state and local sales and use. Carefully read the instructions and other information on the back of this document. As a new york state registered vendor, you may accept an exemption certificate in lieu.

Nys Tax Exempt Form St125

Carefully read the instructions and other information on the back of this document. As a new york state registered vendor, you may accept an exemption certificate in lieu of. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Purchases described in items a through f are exempt from all state and local sales and.

New York State Tax Exempt Certificate Form

Carefully read the instructions and other information on the back of this document. Purchases described in items a through f are exempt from all state and local sales and use. Businesses can apply for certificates that exempt them from paying sales tax on certain items. As a new york state registered vendor, you may accept an exemption certificate in lieu.

FREE 10 Sample Tax Exemption Forms In PDF

As a new york state registered vendor, you may accept an exemption certificate in lieu of. Purchases described in items a through f are exempt from all state and local sales and use. Carefully read the instructions and other information on the back of this document. Businesses can apply for certificates that exempt them from paying sales tax on certain.

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate

Businesses can apply for certificates that exempt them from paying sales tax on certain items. Carefully read the instructions and other information on the back of this document. As a new york state registered vendor, you may accept an exemption certificate in lieu of. Purchases described in items a through f are exempt from all state and local sales and.

As A New York State Registered Vendor, You May Accept An Exemption Certificate In Lieu Of.

Businesses can apply for certificates that exempt them from paying sales tax on certain items. Carefully read the instructions and other information on the back of this document. Purchases described in items a through f are exempt from all state and local sales and use.