Unexpired Insurance Adjusting Entry

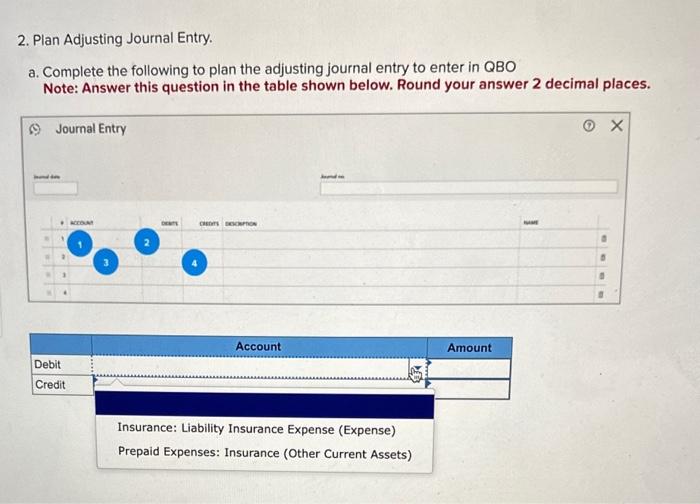

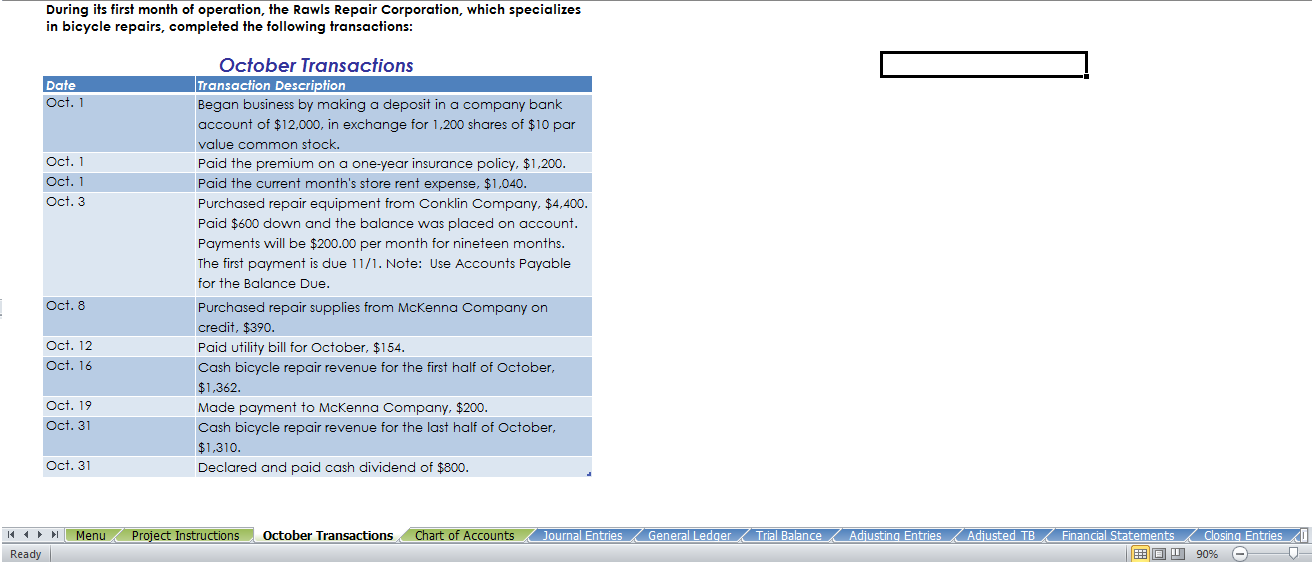

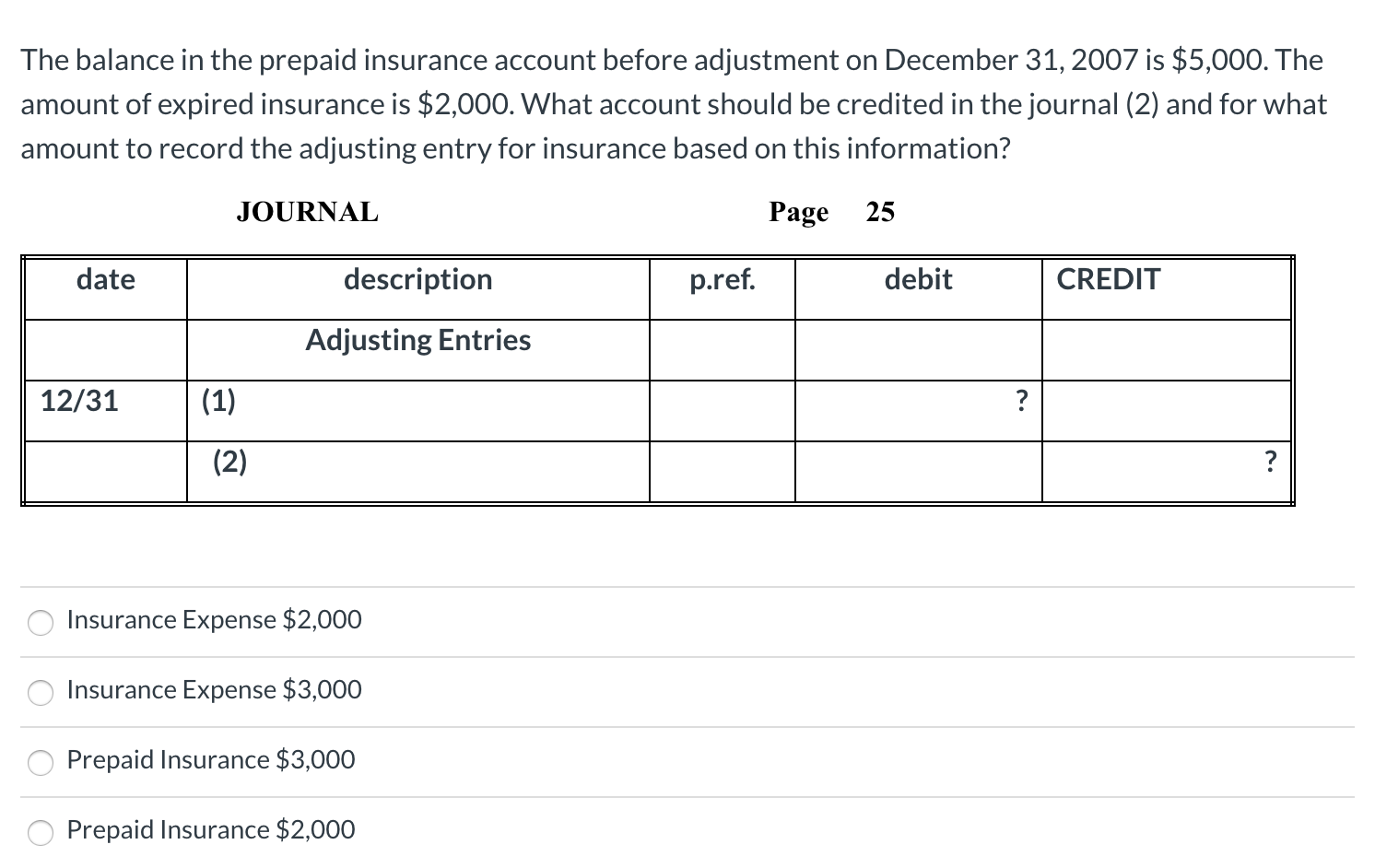

Unexpired Insurance Adjusting Entry - Therefore, the adjusting entry will be: For the second situation, the amount of unexpired. You reduce the prepaid insurance account by $125 and make a journal entry for. You need to adjust the entry for unexpired insurance to account for the reduction in assets. Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance.

Therefore, the adjusting entry will be: Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. You need to adjust the entry for unexpired insurance to account for the reduction in assets. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. For the second situation, the amount of unexpired. You reduce the prepaid insurance account by $125 and make a journal entry for.

When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. You reduce the prepaid insurance account by $125 and make a journal entry for. Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. Therefore, the adjusting entry will be: For the second situation, the amount of unexpired. You need to adjust the entry for unexpired insurance to account for the reduction in assets.

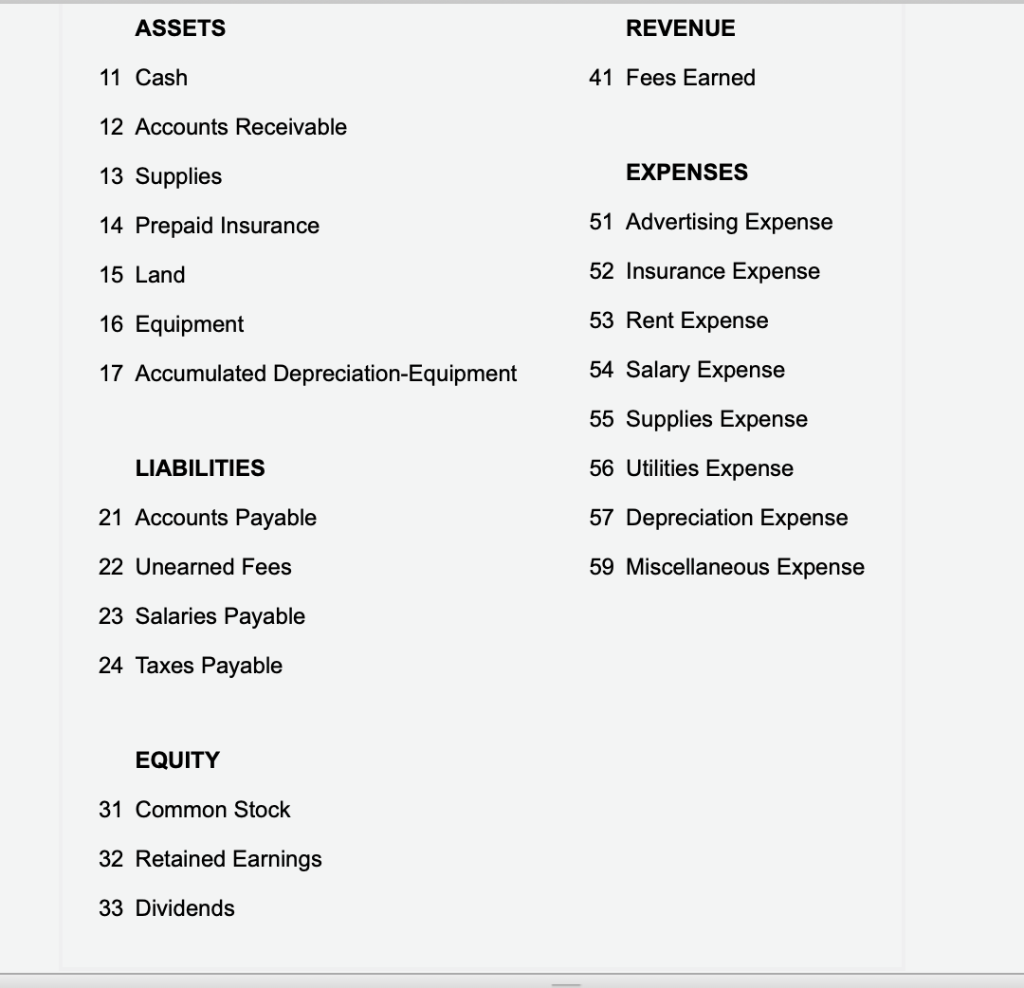

Adjusting Entries Adjusting Entries Insurance Expired

For the second situation, the amount of unexpired. You reduce the prepaid insurance account by $125 and make a journal entry for. Therefore, the adjusting entry will be: You need to adjust the entry for unexpired insurance to account for the reduction in assets. Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense.

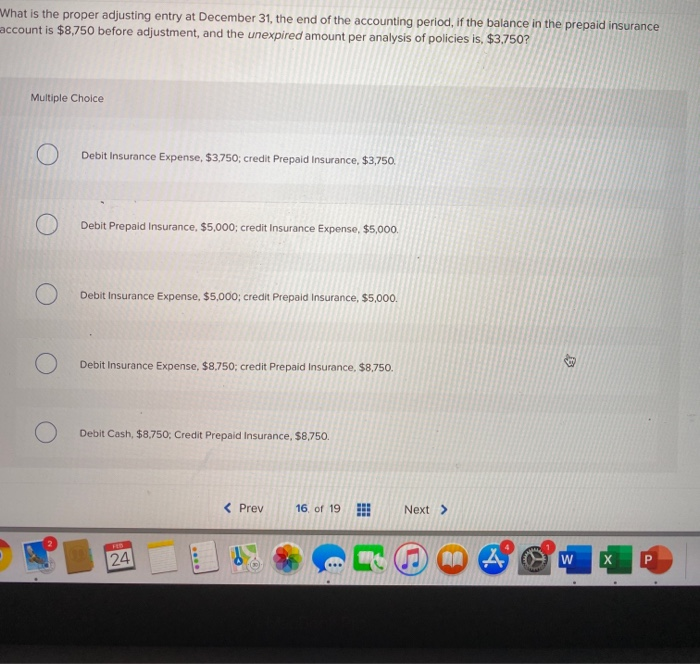

What is the adjusting entry for expenses? Leia aqui What is the

For the second situation, the amount of unexpired. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. Therefore, the adjusting entry will be: You reduce the prepaid insurance account by $125 and make a journal entry for.

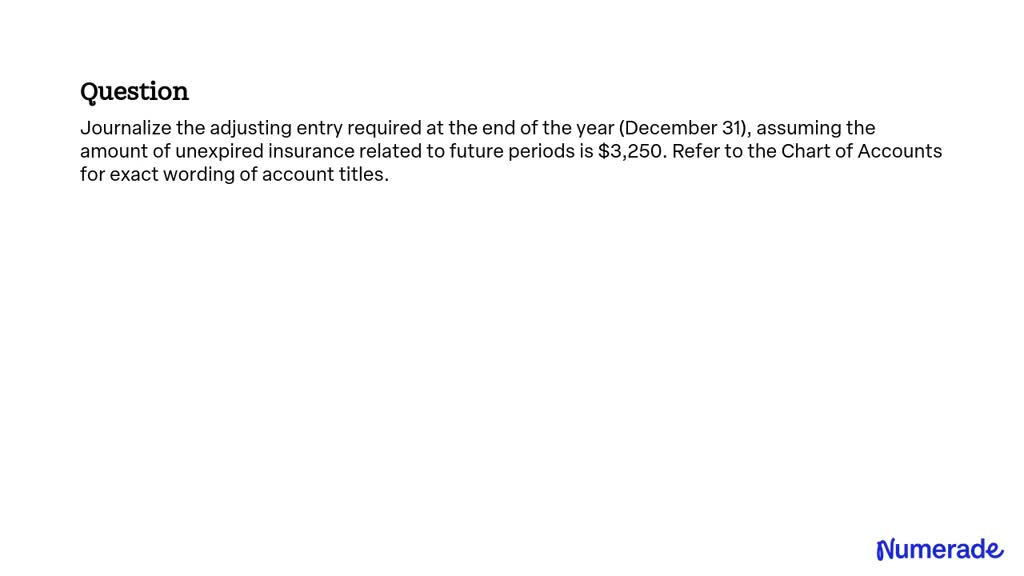

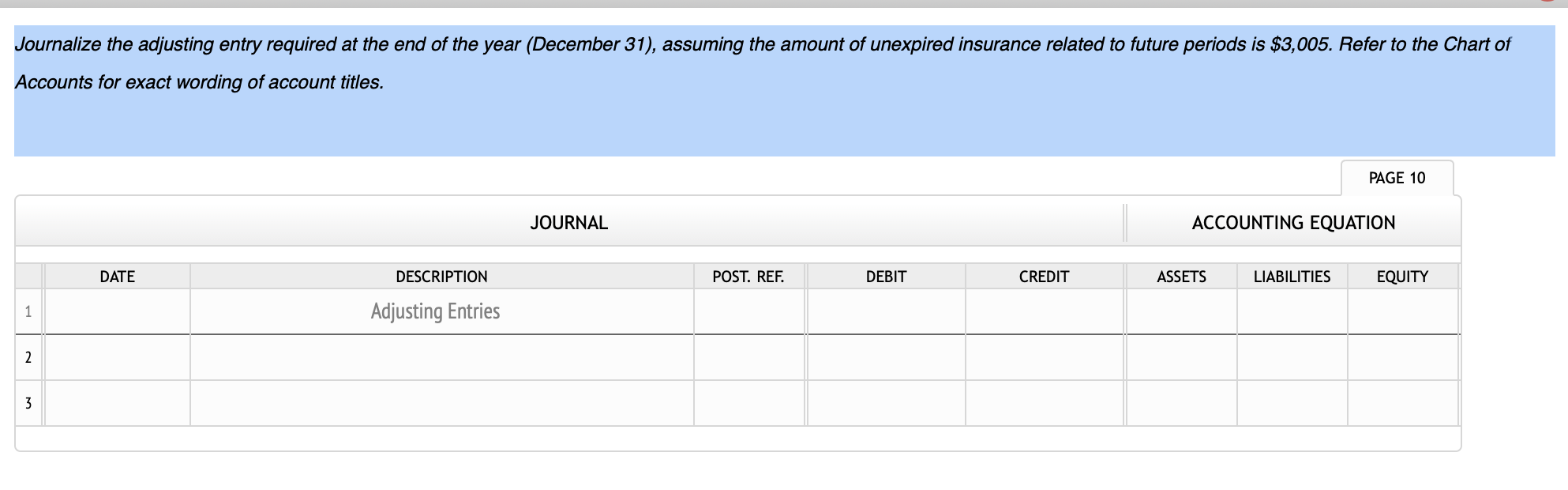

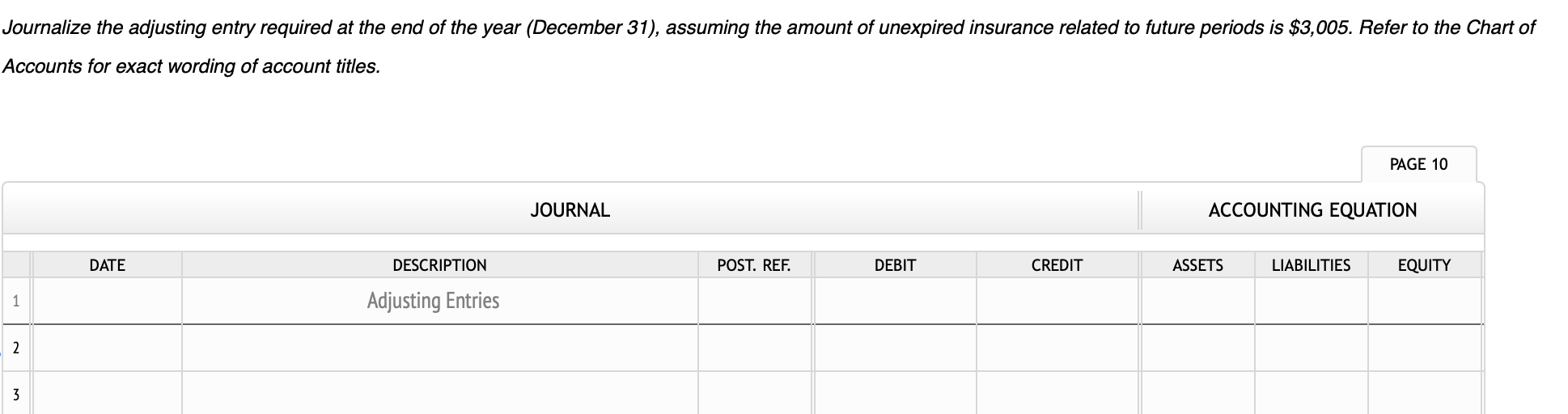

SOLVED Journalize the adjusting entry required at the end of the year

Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. You need to adjust the entry for unexpired insurance to account for the reduction in assets. You reduce the prepaid insurance account by $125 and make a journal entry for. For the second situation, the amount of unexpired. When a journal entry has to be.

Unexpired Insurance Adjusting Entry Life Insurance Quotes

For the second situation, the amount of unexpired. You need to adjust the entry for unexpired insurance to account for the reduction in assets. Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. Therefore, the adjusting entry.

Solved Journalize the adjusting entry required at the end of

You reduce the prepaid insurance account by $125 and make a journal entry for. Therefore, the adjusting entry will be: For the second situation, the amount of unexpired. Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance.

Solved What is the proper adjusting entry at December 31,

For the second situation, the amount of unexpired. Therefore, the adjusting entry will be: You reduce the prepaid insurance account by $125 and make a journal entry for. You need to adjust the entry for unexpired insurance to account for the reduction in assets. When a journal entry has to be made for the prepaid insurance to be adjusted for.

Unexpired Insurance Adjusting Entry Life Insurance Quotes

Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. Therefore, the adjusting entry will be: For the second situation, the amount of unexpired. You reduce the prepaid insurance account by $125 and make a journal entry for.

Adjusting Entry for Prepaid Insurance Financial

You need to adjust the entry for unexpired insurance to account for the reduction in assets. For the second situation, the amount of unexpired. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. Therefore, the adjusting entry will be: Learn how to record unexpired insurance (or prepaid insurance) as an asset and.

[ANSWERED] The prepaid insurance account had a beginning balance of

For the second situation, the amount of unexpired. You reduce the prepaid insurance account by $125 and make a journal entry for. You need to adjust the entry for unexpired insurance to account for the reduction in assets. Therefore, the adjusting entry will be: When a journal entry has to be made for the prepaid insurance to be adjusted for.

Solved EM9.3 Adjusting Entry Prepaid Insurance At January

You reduce the prepaid insurance account by $125 and make a journal entry for. You need to adjust the entry for unexpired insurance to account for the reduction in assets. Therefore, the adjusting entry will be: When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. For the second situation, the amount of.

Therefore, The Adjusting Entry Will Be:

You reduce the prepaid insurance account by $125 and make a journal entry for. When a journal entry has to be made for the prepaid insurance to be adjusted for insurance. Learn how to record unexpired insurance (or prepaid insurance) as an asset and an expense. You need to adjust the entry for unexpired insurance to account for the reduction in assets.

![[ANSWERED] The prepaid insurance account had a beginning balance of](https://media.kunduz.com/media/sug-question/raw/84364682-1657472691.555834.jpeg?h=512)